This week on Mining Money, Brandon Davis, CEO, of Swan Energy gives some advice for those stuck in a world of uncertainty.

Davis gives some advice on ways to overcome the “analysis to paralysis”, which is prevalent in today’s market.

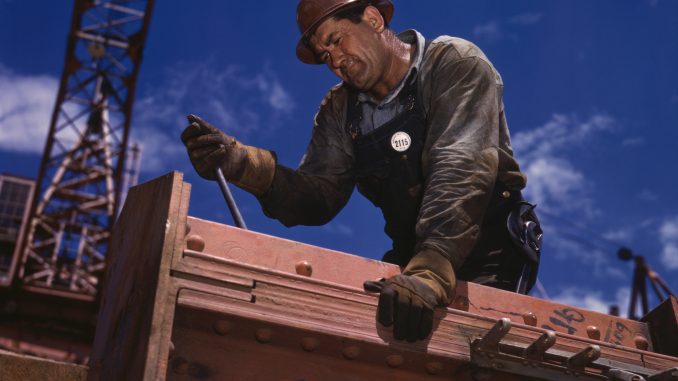

Brandon Davis, Swan Energy.

Jason Spiess: Thank you very much for joining us here today, folks. We’ve got the CEO of Swan Energy joining us for Mining Money and I-I am so pumped today, because out of all the people I know, Brandon, you are one guy that seems that you go out and get it and you go out and… It… Okay, here’s where it comes— A couple nights ago, my neighbor – he’s running for House of… you know, he’s running political office, trying to be a House Representative type thing, and he had some people over, and they were talking about the uncertainty out in the marketplace. People aren’t sure, kids, school, all these different things. And I remember back when I suffered my first downturn in the oil industry. I went into a analysis of paralysis because I had to reinvent my business model again and I didn’t know what to do. It was a newer industry, the, you know, so much technology was coming in. I just wanted to go into a corner, rock back and forth in a fetal position, because I didn’t know what to do. So, I got over it, of course, but that is so common. And I think a lot of people are going through that right now and I— There was… The other night at that, at that political get-together I was at, that’s for sure. Because everybody seems to have all the answers but nobody’s willing to take a step forward. You seem like the kind of guy that usually takes a step forward regardless so, uh, I-I wanted to talk to you about that today. How are you doing? It sounds like you’re on the road.

Brandon Davis: Uh, I am. I’m on my way to an appointment, and, uh, I’ve got a sinus infection, so pardon my nasally noise here. Um, by the way, it sucks to have a little bit of a cold right now, because if you cough or sneeze or someone sees you blow your nose, you start getting looked at like, ‘that person that could kill the room.’

Jason Spiess: Isn’t that true?

Brandon Davis: It’s an experience I’ve never had before today. The last few days and I’m like, okay, well, I guess that’s-that’s an interesting way of looking at things. Um, so, it’s-it’s been it’s been a trip to, say the least.

Brandon Davis: It’s a little difficult, because, like, it— Where I’m at, a lot of places require you to wear masks. In fact, there’s a, there’s a city commission fight going on right now, whether the city should require everybody to and that sort of thing. But I’ll be honest, when I put the mask on, I, you know, it’s-it’s hard for me and I cough, and then people are looking at me, and at Walmart, and I’m going, ‘great, now is security gonna come over?’ So, I can’t even imagine having a sinus infection. Ooh that would be— ah, anyway.

Brandon Davis: First of all, you need to quit whining about wearing a mask. It’s not that bad. We have to do it here, too, in Houston, so—

Jason Spiess: But it-it-it makes it a little different though, because it is—

Brandon Davis: It makes it hard to breathe!

Jason Spiess: That’s what I’m saying.

Brandon Davis: Absolutely!

Jason Spiess: That’s what I’m saying.

Brandon Davis:It sucks. And I’m with you. I’m not, I’m not a, I’m not a, like, a supporter or a fan of the process. But it’s what helps get rid of this; that’s fine with me if I can still act like normal otherwise, which is basically how it is here, so—

Jason Spiess: I can do it, I can—

Brandon Davis: I could, I can live with that for now, you know.

Jason Spiess: Oh yeah, I came to terms a long time ago with, if I want freedom, I got to own my own property and then I can have as much freedom as I want within a certain amount of rules, right? But when I go out in the world, man, I gotta abide by rules, and right now there’s a, there’s a mask rule in a lot of different places, and I don’t particularly like it. Like, what you said, it’s hard to breathe in those things, it is, and I’ve been tested—

Brandon Davis: It is, it is.

Jason Spiess: And I’ve been tested. I’m COVID-free, so, I mean, you know, it’s not like— But there’s a certain perception and again— But that’s, that feeds into what I was originally prefacing this conversation. By the way, uh, Mining Money here, folks. And we’re gonna get into some m-money talk in just a second. But there’s a lot of fear out there. There’s a lot of uncertainty out there. I just talked to the Dallas fed yesterday. They got done with their quarterly reports and a lot of people were talking about uncertainty with oil prices, uncertainty with Joe Biden, uncertain— These are actual written in the comments, uncertainty about Joe Biden, um, because… He gave me the pdf of the report, and I started looking through them, and a lot of people can get into an analysis to paralysis so easy, and that’s pretty common in business. It’s pretty common and I, like I said, I’ve been through it. So, um, what advice would you have, or what experience have you had? Before we get into some, you know, specific money talk with that as far as either getting over that or recognizing when it happened to you. I don’t even know if it’s ever happened to you, because you got— you see, what—

Brandon Davis: Happens to me on occasion.

Jason Spiess: Okay, okay.

Brandon Davis: And, um, when I realize it – which sometimes it’s too late. Sometimes you, sometimes you can think too much on something, to the point where you just have to basically flush it, um, and move on, because you’re you’re caught in a quandary. But because it’s not always exactly clear what to do, no one has all the answers, so there’s a little bit of chance, a little bit of gut, and, um, and thinking on your feet to get you to the point of acting. And, you know, it doesn’t happen to me often, but it does hap— I’ve seen it happen to people to the extent that, literally, I had to start making decisions for them until they got over it. [Laughter] It happens.

Jason Spiess: It-it- it can break you. It can, it can seriously break your self-esteem if you can’t get over it. I’ve seen it and it’s tough.

Brandon Davis: My-my theory is this: that you know if you’re going to do something and you know what you want to do and you have an idea of how you want to do it, lay out the idea and go do it and you’ll learn on the way. Um, you cannot plan for everything, ever. It doesn’t matter who you are, how smart you are, how much money you have, there’s no way you can do that. So, a good portion, 99.9 percent of the time, uh, your plan is going to change. Every time. It’s just gonna happen. So, uh, the way I look at it is-is, you- you know, even if it comes to a point where it’s like, ‘well we go left or we go right,’ you flip a coin and go and-and see what happens. I mean, it’s just, that’s just how it works.

Jason Spiess: That’s right.

Brandon Davis: There’s a lot of, there’s a lot of people out there that want to start businesses that always have these ideas and talk about these things, but never go anywhere with it, um, because they overthink it. Like, the-the biggest, the thing that makes businesses work are the people that run them, push them, and start them. That’s, it’s not the business itself, so obviously it’s easier later if-if you can get a business rolling that-that will ultimately take care of itself. Um, but in the beginning, it’s just, it’s all you.

Jason Spiess: Well, one of the reasons why we like to have Swan Energy and yourself come on here is to create momentum, because the way I kind of got through my analysis paralysis— Like I said, I, mine was rocking back and forth at a fetal position in the corner. That’s-that’s how my metaphor is. Like, when you’re at that position, you gotta, you-you gotta just flush it, like you said.

Brandon Davis: Yep.

Jason Spiess: Sometimes you just gotta cut-cut it and move on and—

Brandon Davis: Yep.

Jason Spiess: And for me, it’s when I get to that fetal position in the corner where it’s just, this is all I got left. So, you’re rocking back and forth in the fetal position. You’re still got momentum going. So getting back to momentum, that’s when I realized life is really a lot about momentum, and one of the reasons— Again, Mining Money is— We want to find out where the momentum is going in certain investment areas, because you need to create momentum in your life, because if you’re getting into that analysis of paralysis and you’re sitting around waiting for things to happen, guess what? You do have momentum, only it’s going backwards. You’re not in control of your momentum, because life is moving on without you. When I think of right now— Last week, when I was talking to Imran and Jeremy, they brought up a good point about buying stocks when it was low and buying Ferraris if it was half price and that sort of thing. Can you think about how much, uh, PPE products are going to be needed when flu season hits COVID season? Can you imagine how much more is going to be needed when the people are working from home and all of a sudden, their heat is now at 71 degrees instead of 67 degrees while they’re at work? I mean, we’re talking about a big shift of energy here, to where I could easily see a lot of oil and gas. Because, again, folks, we’re still 93, 95 percent of fossil fuel society (subsiding?), whether you like it or not. That’s how where we’re at. So, um, momentum and the future of the oil and gas industry, I guess, is where I’m going with the question, so I don’t know if you want to grab the momentum question, but I did want to transition into the PPE stuff in terms of, uh, why I believe the oil and gas industry is a great place to invest right now.

Brandon Davis: The oil and gas industry is a great place to invest right now, because it’s at an all-time low and-and-and I-I believe when the economy comes back, so will the price, which is going to, um, be fun for-for those of us that are being, that are quite active in acquisitions and development. Right now, um, we’re doing more work right now than we did the first half the year, uh, which is kind of surprising actually to say that. I-I didn’t really think about it until it just now. Um, and-and it’s exciting because the deals that we’re working on work at 40 dollars a barrel, um, if, of course, they have oil in them – you never know – um, and enough oil. But it’s nice. There’s a lot of opportunity right now and there-there’s a lot of non-oil and gas people getting out of the business. We’ve acquired one, I think we just agreed on terms on a second one today, um, where the people were investors from another place, another country, and just wanted to get out, because it’s really hard right now. And right now, it’s probably, um, one of, if not the hardest time in the oil and gas business in a long time just because of the sustained low price. Um, so, I think there is a ton of opportunity. And as far as, uh, Ferraris for half price, you know, I wouldn’t take one, but I, but I’ll definitely buy production and an acre and wells that, uh, that are worth about half of what they were six months ago, uh, all day long, because that that’ll actually make me some money. I don’t need a Ferrari. I’ve had one, don’t, not excited about them.

Jason Spiess: So you mentioned you’re a little bit surprised by making things work at 40-dollar oil. Is that, is there any secret to that, or is that just innovation catching up, or are your, are the, you know, midstream companies sharpening their pencil that much, I guess?

Brandon Davis: Uh, well, it’s-it’s all about what you buy and how you buy it.

Jason Spiess: Yeah.

Brandon Davis: Right, so, um, if, for example, we bought a well that was drilled and cased and needed to be completed, so our economics on just completing that well are far better than they would have been if we had drilled it, too. But the company that had it didn’t want to complete it, so they were having financial changes. It wasn’t even challenges that caused the management, uh, to basically disband and get rid of the asset. So, it worked out really well for us, and that happens. And there’s getting ready to be a lot more of that coming. I think the next six months are going to be very interesting on that side.

Jason Spiess: You mentioned foreign investors. Is that, is that starting to pick up again in terms of interest and inquiries?

Brandon Davis: No, it’s the opposite.

Jason Spiess: Okay.

Brandon Davis: It’s the opposite, it’s the opposite. They’re all bailing out.

Jason Spiess: That’s what I thought you said a couple weeks ago, yeah.

Brandon Davis: Yeah, and that’s what we’re-we’re, you know, that’s, we’re buying some of that and there’s-there’s a lot of really good opportunities out there right now, and I’m just, I’m surprised.

Jason Spiess: I see. They’re bailing, so they, that’s how you’re getting it; they’re bailing.

Brandon Davis: Yeah.

Jason Spiess: So that’s how you’re getting it, okay. I thought they were coming back in, but okay, no. All right, good deal. That’s funny.

Brandon Davis: Well, it’s-it’s just business. I mean, I-I can tell you that I’ve tried to run businesses from a distance. It’s hard, and, uh, and if-if that, you know, from-from here to Oklahoma, it’s hard. I can only imagine coming from another country.

Jason Spiess: Yeah, that’s actually—

Brandon Davis: Totally different language—

Jason Spiess: Yeah, it’s a totally different culture shock, I mean, state to state—

Brandon Davis: Everything—

Jason Spiess: You got, you got county regulations and that sort of thing, so now you start folding in the language barrier and culture and everything else, that’s very difficult.

Brandon Davis: Well, just, oil and gas is the most difficult industry in the world. It’s the most, it’s not conformed. There’s no exact, there’s no— The process that works in one area doesn’t work in another, and that other area could be across, you know, across the river. So, you know, it’s-it’s a very tricky business and, um, it’s very, um, uh, it’s hard to navigate. I-I just I couldn’t imagine doing it, um, I couldn’t imagine. I’ve had people come to me and say they have really good economic opportunities outside the country, and I-I just, I just have no interest, because I have, I have no idea what I’m getting into. Um, and I think that’s probably what these guys are realizing. It’s-it’s a lot harder than it looks.

Jason Spiess: So Swan Energy, you guys are finding some pretty good deals and some pretty good, uh, monies, if you will, making things work 40-dollar oil. We’re looking at, you know— I was talking to Dallas fed yesterday and they mentioned the first and second quarter we, you know, they saw 60 plus percent drops, you know, declines and this last quarter was only a six percent, so the stabilization seems to come. That’s why I believe right now, over the next, well, last month and then probably over the next, I don’t know, a week or two is probably going to be, that’s it. And then I think prices are probably going to go up a little bit after the election or right before the election. That’s just kind of looking at the tea leaves. And I know there’s COVID, and I know there’s uncertainty, and I know this is the oil and gas industry, but you can certainly follow the energy and the trends at times, and it certainly seems going more positive direction than what we experienced the first half of 2020.

Brandon Davis: I hope you’re right on the price. Um, I think it’d be great if it came up. It’d be awesome if it came up a lot. But overall, there’s, there is a lot of uncertainty and who knows, I mean, I-I, who knows what’s going to happen in this winter when it gets cold and everybody starts getting the flu and COVID’s going on. I just, we’ll see. Um—

Jason Spiess: Well, that’s what I’m saying. I-I think the consumption is going to go up without a doubt, just, just off of—

Brandon Davis: Well, it has— it’ll have to.

Jason Spiess: Right, just just off of temperatures and the fact that we need more PPE products. I don’t know. Last time I checked, most of these personal protection equipments that all the hospitals and schools and businesses are ordering, they’re made out of plastic. It’s not, these are not glass masks. These are nylon and different fabrics and—

Brandon Davis: Oh yeah—

Jason Spiess: All kinds of things, so I-I mean that’s what I’m seeing is I’m seeing an increase in demand for oil and gas products as necessity for society. That’s why I think this is really an important time to invest because it’s gonna, I mean, this-this is one of those times where we’re gonna look back at it and say, ‘Wow, if I only would have done then, but—’

Brandon Davis: I had a buddy tell me, um, earlier today that if you can’t make money over the next six months that we’re gonna see, then you’re probably never going to, and he was kidding, but the point was that there’s going to just be that-that much opportunity out there, um—

Jason Spiess: No, that’s true—

Brandon Davis: You know, it’s like going to a buffet instead, as far as opportunities to-to do things, versus what it was a year ago. You had to scrounge it up on under the table. So, it’s just, there’s a lot of things moving right now and good and bad but, you know, movement is what makes the world go around. Whether it’s up or down, it doesn’t matter, um—

Jason Spiess: Well, I was—

Brandon Davis: Something’s going up, something else is going down. That’s just the way it is, so—

Jason Spiess: Well, I remember after the, um, the PPP loans and the care Zach(?) stuff and, you know, when the dust settled, basically my message was, ‘Hey guys, they just printed, like, three, four, or five trillion dollars. Go get it. They just printed it. Go get it and—’

Brandon Davis: Well, yeah, right after they did that, all these people started buying houses and shit, too. It was crazy.

Jason Spiess: Well, that’s just it. That’s what I’m saying is people, you can get as upset or happy or whatever, but the point is that was a lot of money to really inject into the marketplace. And what you’re saying is right, though, is there is a time period and there almost is a little bit of an expiration date that happens when that kind of that gold rush goes away. And I totally agree; the next three to six months after that, it’s going to be tough. I believe that. I do.

Brandon Davis: Between now and the end of the year, it’ll be interesting to see what happens.

Jason Spiess: Well, that’s why I’m heading down to Texas.

Brandon Davis: Smart man. Um, I don’t blame you. My kids are in school and that’s a little bit different than it used to be, um, but, I-I, the whole PPP angle is interesting. I hadn’t really thought about that much until you said that. I’ll-I’ll do some digging on it, um, very interesting.

Jason Spiess: Well, that’s-that’s really, you know, I-I talked to the fed-federal reserve guys about that off the air a little bit, because they-they wouldn’t budge on the air, um, and in fact, I even edited it out because it was, it was worthless. But, um, my point was is I-I believe that-that did inflate the marketplace a little bit and I don’t know if it’s good, bad, or indifferent. All I know is that you can’t dump that much money into a marketplace—

Brandon Davis: Oh, of course.

Jason Spiess: In such a small—

Brandon Davis: It absolutely does.

Jason Spiess: Yeah, and-and so to not have any sort of analysis back from, you know, the people that get paid millions of dollars, I was, I was kind of challenging a little bit on that, because that’s-that’s an important part of the story right now. [Laughter] It really is, you know, and so—

Brandon Davis: Sure it is.

Jason Spiess: Well, yeah, because a lot of people I talked— Like I said, I was at that political fundraiser type event and listening to some people. Half the people are waiting for the next round of checks. That’s why I’m like, ‘You guys are just, and you, you’re paralysis-ing yourself into a corner.’ I mean, you can’t just sit around and wait for a government check when, especially when they haven’t said they’re going to give you one. [Laughter]

Brandon Davis: Right?

Jason Spiess: Sorry, I just, I got a kick out of that, but, uh—

Brandon Davis: Oh, it’s entertaining. I mean I-I can assure you that, um, there are a lot of those people right now doing that, and you know, I feel bad if that’s what they’re depending on. But at the same time, just like we’ve always done in this country, you’ve got to go earn your keep and earn and-and make it happen. You can’t sit around and wait. Those who sit around and wait lose. That’s the way it is.

Jason Spiess: So are you guys still doing joint operating agreements and taking investments from, uh, people and that sort of thing? Is it, um—

Brandon Davis: We’re always taking investments from people and working with partners on-on different things, and we do, um, many different kinds of opportunities. We have— so, um, swanenergyinc.com, if you’re curious. And, uh, yeah, we have a lot going on right now.

The Crude Life Podcast can be heard every Monday through Thursday with a Week in Review on Friday.

Spread the word. Support the industry. Share the energy.

If you have a chance, check out The Crude Life Podcast!