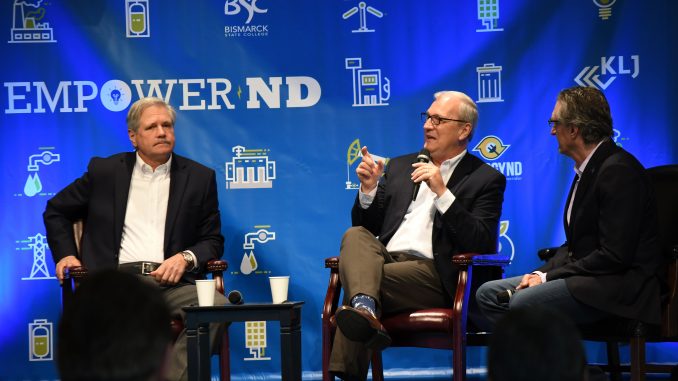

U.S. Senator Kevin Cramer gives an outlook for energy companies as they prepare for 2021. Cramer discusses in detail one of the main issue upfront is federal leases.

Cramer explains how the western states will be hit hard by a federal ban with North Dakota getting hit hard. He says that the unique nature of mineral ownership involve private, state, tribal, and federal minerals often within the same section or spacing unit.

Cramer talks about working with president-elect Joe Biden what to expect with a Biden/Kamala presidency. He says that so far many of the announced members of leadership seem to be the same faces from Barack Obama’s presidency.

He also comments on small business owners and what challenges they have seen in 2020. Host Jason Spiess asked Cramer if the industry was at a cross roads with access to leadership and government intervention into the market. Spiess cited API president Mike Sommers’ comments last March animatedly against government-controlled production, and juxtaposed with then-Parsley Energy’s CEO Matt Gallagher’s appearance in CBNC asking for government intervention with the market, only to be sold to Pioneer Natural Resources months later.

Cramer said it is hard to find a free market in today’s world, but America still has the pieces in place to capture capitalism and domestic economic security. He continued saying if the oil and gas industry continues down the direction its heading, there will only be “only four companies” making all the decisions for the globe.

Cramer transitioned to the global market, citing his work with Saudi Arabia over the past year. He said he has been working very hard to ensure there are no more shenanigans with Russia and OPEC.

New leadership in energy, the New Green Deal and Democrat Sheldon Whitehouse are also interview topics.

U.S. Senator Kevin Cramer: This is Kevin Kramer representing proudly, the state of North Dakota in the United States Senate, talking to Jason Spiess, who’s, like, the best energy interviewer in the world. Is that too much?

Jason Spiess: That is not too much. In fact, we might even have to turn that into a promo or something. You know, I, you know, I, someone was just asking me the other day, somebody in politics, because they noticed that I’ve had a little bit of a decrease of, uh, some-some politicians on in the past couple years, and we’ve focused more on a lot of the business owners and kind of that supply chain, if you will, because—

U.S. Senator Kevin Cramer: Yeah, interesting people, yeah.

Jason Spiess: Well, you know, it’s just there, it’s just, you know, how the market goes. You got to go where the market is, and somebody asked me, and I said, you know, I’d have to put Senator Kramer up there. And they looked at me kind of bizarre and they go, “Why?” And I said, “Well, for number one, he’s always accessible,” and I said, “If you look at the last, you know, four, three, four years, it’s been like a rare albino elk sighting for a lot of people. You know, they’ve-they’ve been, they’ve been going and hiding.” And, you know, some people are having a hard time, you know, with when the energy started crashing and then also when COVID came out. Not you, though, not you, no. I said, “The other reason I like them is because we don’t always see eye to eye and we’ll have civil conversation, and at the end, we’ll understand where each other’s coming from, because we’re still, we’re trying to get to the same spot and we always know that.” So, anyway, I’ve always, I’ve put you in one of my favorite politicians through the years and I’ve been doing this now for over 25 years.

U.S. Senator Kevin Cramer: Yeah, it’s amazing for a guy so young. I don’t know how you squeeze those 25 years into such a short time but, um, the thing, Jason, I was saying, I always tell the reporters here – although I chewed their butts yesterday, the media here at the capitol – but I always tell them we’re in the same business basically, and that is to inform people what we’re doing, you know, what’s going on in the capital. It’s just when sometimes they lose their way in what they inform people. But anyway, you can only do that by talking to each other, I guess.

Jason Spiess: Well, and you bring up a good point, especially going into 2021, you know, we have a new president now, President-Elect Biden, who has been very open about his feelings towards the fossil fuel industry. We have small businesses just clinging on to anything they can find right now, and-and, you know, before you this kicked in, it was already starting to be a little bit difficult for a lot of the energy industry. So, uh, you spent a lot of time in the administration, Trump’s administration, uh, in the energy sector. Talk to me a little bit about, uh, what energy companies should know right now and what they should be considering and thinking about going into 2021.

U.S. Senator Kevin Cramer: No, that’s a great question and one thing about, you know, any successful businesses, you have to look forward and you have to look forward with, you know, realistic, um, expectations, and of course prepare, uh, prepare for for what might be coming. And obviously the energy sector is very dependent on public policy, all businesses, but-but especially energies. Especially when you’re a net exporter like we are now as a country, that means geopolitics matters and so clearly, they have to be preparing for Biden-Harris administration. And we should have some, you know, some sense of what that looks like because, you know, of the playbook from the Obama-Biden administration, and it already looks, at this very early stage, like the Biden-Harris administration’s going to look a lot like Obama-Biden, because so, like, 75 percent of the people that he’s announced, that he’s going to nominate for-for offices in the cabinet, um, you know, worked in some capacity for the Obama-Biden administration. And-and I’m not criticizing, now, I’m just stating that as a fact. So, I, you know, we do have some sense, I guess, based on history. And, of course, remember during the Obama-Biden administration, there was a lot of sue-and-settle tactics between the agencies and the environmental groups that were then followed up with by stringent regulations often beyond their legal jurisdictions. And then they’d also slow walk every permit, you know, possible. And so, the federal government has a lot of control, everything from tax policy to environmental policy, and not even just the policies themselves – we can talk about that a little bit – but-but how these policies are administered, how rules are enforced. It’s not just the regulation. It’s the regulator. And so, there’s lots of ways they can slow walk things. So, when the Trump administration came in, for example, the North Dakota Bureau of Land Management had one of the highest APD backlogs in the country. That’s Applications for Permits to Drill. And for the oil and gas industry, it’s really clear they’ll immediately go after methane regulations for new and existing sources, and some type of prohibition to lease and drill on federal property. Now, one of the reasons the Bakken took off, you know, much bigger and faster than other plays, besides the fact that it’s a very oil-rich play, is that a lot of North Dakota is not on, is not owned by the federal government. But we also know that much of the heart of the Bakken is on and federal property. And so, you know, some type of a prohibition to lease and/or drill on federal land will be a really big issue for North Dakota. And, um, you know, we-we also know that there’s about, uh, what, I guess— Lynn Helms is saying there’s about 48 percent of North Dakota’s spacing units that have some amount of federal minerals, so even if it’s not federal land, we do know that with our unitizing and whatnot, that-that there’s a lot of federal minerals. And 48 percent is quite a bit. It’s a substantial amount that-that you will lose access to, and that means a lot of lost revenue for neighboring mineral owners and governments production for our economy still largely utilizing oil now and many years into the future, so.

Jason Spiess: Let me just jump in for one second. I just want to paint a picture for somebody out there that maybe isn’t following, that is, basically what we’re talking about is that, you know, you could start drilling on your specific area but because these laterals go several miles underground horizontally, you could be entering into a federal type of a jurisdiction, if you will. We just had Kathleen Scama on. She’s the president of the Western Energy Alliance, and that is a big deal out west, of course. You start, you-you get west of the Black Hills and about every other foot is federal land in some way or another, so it becomes a little bit tricky. And that’s interesting to hear about North Dakota having it. I didn’t know it was that high. I didn’t know it was that high.

U.S. Senator Kevin Cramer: Yeah, so, when you think of 48 percent, and what Lynn is saying is that, so, 48 percent of our spacing units have some amount of federal minerals, so-so it’s it’s not 48 percent is federal, it’s 48 percent of the units have some amount of federal minerals. And what that means is, to the illustration you just pointed out, that-that means that you could lose, companies could lose access to, you know, um, a resource that’s vast majority of which is private, but if there’s a little bit of federal in there, um, then there’s becomes jurisdictional problems. And-and even if you can, you know, get the right percentage worked out, you know, as an investor, you’re going to look to, well, where would it be easier, you know, where would it cost me less, what is it less hassle. And so even in North Dakota, a federal prohibition could become a really big problem. Um, now we also have, you know, because of politics, we have this Georgia runoff election, you know, the Senate election, and right now Republicans have 50 Republican senators, there’s 48 Democratic senators, and these two will determine whether Republicans or Democrats control. And-and so control of the Senate is a big thing, but we need that control as Republicans in this pro-energy, um, States to prevent any drastic law making that, you know, that would try to satisfy the Green New Deal, uh, proponents, for example. So, um, you know, elections have consequences, and-and while a Biden-Harris administration will be able to use their executive powers in lots of ways, at the very least, if we maintain control of the United States Senate, we can prevent big policy changes and, you know, additional taxes or, um, you know, like, say, Green New Deal types of legislation. Now, from a market perspective, we were, you know, the COVID-19, um, pandemic has clearly demonstrated and illustrated and highlighted the vulnerability of supply chains, so it seems like when, you know, right now, I think oil’s, as we record this, somewhere around 46, 47 dollars a barrel. I mean, 50 would be better, but it’s a-at least it’s much better than it was when it was negative. And-and I think we’ve seen, you know, we’ve worked hard. I worked very hard on bringing Saudi Arabia a little closer to in compliance, um, but-but we’re bringing oil inventory numbers down with prices improving. But then you have New York and California and Europe now see more restrictions on their economies and citizens and then price, you know, comes back down. The vaccine is, hopefully, will provide some of what people are looking for to eliminate the COVID-19 restrictions, and then we get activity to get market back. The biggest problem we have in the oil industry, from a pricing standpoint, is that there’s market share obviously in that demand is way down, because travel’s way down. I travel every week, as you know, and so I can see it pretty clearly. So, May 21, I think, futures were at 47. A couple days ago, it’s the highest price on the charts, so we’ve got a little ways to go, um, but I’d also be watching, Jason, from a policy example, from a geopolitical standpoint, see what Iran, Russia, Saudi Arabia do and what the Biden-Harris administration would do in response. Because we already know that the Biden-Harris administration wants to re-engage Iran, for example, and Iran has already up to their, they’ve announced what they want to do in terms of upping their production once the sanctions are lifted. And Iran, you know, becomes a pretty major player, pretty major competitor. Saudi Arabia has been playing okay since they pulled off the, you know, this bait and switch on us with Russia here earlier this year, which caused this firestorm. And, you know, I will just gladly tell you I now have the cell number of the Saudi-Saudi princess, who is the Ambassador to the United States, and we talk pretty regularly, so we are, we have a little friendlier relationship now. But, um, you know, if they decide to turn the spigots back on, we could be in a lot of trouble. So, um, production is, I think, around 11 million barrels per day, which is up from 9.7 million that is slow in August, but it’s down from 13.1 a million barrels per day, it’s high in in February, March. So, we’re going to see how these nations play and, you know, politics matters.

Jason Spiess: Well, there’s certainly the demand and energy isn’t going away. And when you look at China’s population, the majority of them, by the way, are aging with the one child policy they’ve had for a long time. India is growing. You’ve got the United States baby boomers, they outnumber generation x and the millennials pretty good, so that, you know, the baby boomers are aging. The pot, the-the globe is, the globe is aging and so the health care facilities are going to need more, uh, energy. And if you go take a look at any municipality, generally it’s emergency services and healthcare facilities that make up most of your power grid. Uh, with that being said, I-I just, I look at the the world of business and some of the, you know, regulations that we were talking about. There was a-a gentleman, Ray Scott out of Colorado. He’s a House, uh, Senate over there on Grand Junction, I think District 45.

U.S. Senator Kevin Cramer: I’ve met, in fact, I had lunch with, breakfast with him once, in Grand Junction, was there on behalf of the Trump campaign four years ago doing an energy—

Jason Spiess: Okay, he was on about, uh, February this time last year or this year, and he made a great comment, which is, “The market isn’t the issue, legislation is the issue.” And I thought that was such a great comment, because, you know, there is a demand out there for a better quality of life, whether it’s from heating our homes or driving our vehicles or getting our goods and services delivered, especially now, to our doorstep.

U.S. Senator Kevin Cramer: Right.

Jason Spiess: What’s missing with this administration, what’s not connecting with a lot of, uh, some of the environmentalists— I saw North Face came out and said, hey, we don’t want to have anything to do with fossil fuels anymore but, you know, we’ll certainly take your orders and deliver them to you. You know, the hypocrisy is just getting out there.

U.S. Senator Kevin Cramer: No, that, Jason, there’s such a disconnect. Part of the problem is you take, uh, North Face as an example, or any other major retailer or distributor of some type, um, and I deal with this in the banking side in a big way, big big way. I’m always fighting the major banks, trying to remind them of their obligation to provide capital to legal businesses and not make these decisions, investment decisions based on political pressure from-from other folks. But all of that, whether it’s political pressure, whether it’s-it’s, you know, pressure from environmental extremists or, uh, you know, even-even in, you know, proxies, proxy wars that a lot of these companies have to deal with, um, it all creates some market. It either distorts the natural market— Well, usually that is the case store in that natural market, so it’s clear that-that some of these companies are responding to that. But to the Senator’s point, um, to race point, you have, you also have a policy that weighs in on that. Policy can either clear the way for a free market or it can distort markets with-with regulations and-and tax policy and credits, and so we all have to be working on that. I think, to the point of the market, it’s not so much about demand – there is a demand shortage as a result of people not traveling – but on the trucking side, you’re exactly right, as there’s less and less small-town Main Street retail and there’s more and more box store, um, Amazon. There still is a, you need to move product and so there is a disconnect. There’s a hypocrisy that is very rich and I think to the degree we can do it and, you know, folks like you do it very well, provide a form to point out that hypocrisy and bring people back to a more reasonable discussion about things that matter to them, whether it’s traditional air pollution or greenhouse gas emissions, you know, the methane versus, you know, CO2, what’s reality in terms of grid reliability, clean coal technologies and innovations that are every bit as as emission-free as others and better for the grid. These sort of in-depth discussions of science and technology absent hypocrisy, um, can be very valuable. It’s just that there are very few forms today where that happens.

Jason Spiess: Concluding here with US Senator Kevin Kramer. Appreciate the time today. I wanted to wrap up with kind of a, probably the toughest question we have today, because it’s, you know, industries going, went through a lot in the last year it, to the tune to where we started seeing some-some government intrusion. Uh, in Texas the, even the railroad commission met several times about controlling production and I’ll, uh, we-we tried to talk about this a little bit and it’s a sore subject, Uh, that’s why I wanted to have you kind of, kind of referee it a little bit, or talk about it a little bit. Because it is, it’s-it’s-it-it’s at a crossroads. Let’s put it this way, uh, Mike Sommers from API, the president of API, I’ll never forget. This story came out about the Texas railroad commission stepping in to control and production, and I swear to you, that reporter didn’t even finish the sentence, and he was already saying, governments stay out, you know, that was the old school way, government stay out! Well, then, about a week later, you had Matt Gallagher, CEO of Parsley Energy pop up on CNBC, talking about, well, maybe we should have the government step in and control production. And I thought, well, that’s pretty good for you, man, because you’re one of the big guys, but the little guys who are out there hustling, they’re probably going to get left out. Well, then a few, you know, months later and, by the way, Matt was scheduled to come on the show here, and then all of a sudden, he just, his people just ghosted us. Well, then they sold, and I thought, okay, well, the frac sand industry just sharpened their pencils again for the fifth time in the last six years. The truckers – I don’t even want to get into the truckers, how they’ve sacrificed, and I’m pretty sure, you know, we’ve heard a lot about a lot of these executives getting bonuses and not having to face the music and a few other things. And I thought, this is a really good example why accessibility is important. So again, thank you, Senator Kramer, but again, it kind of demonstrates how the government can kind of pick winners and losers without even trying. It’s just, there’s certain ways in certain businesses are already in motion that need to be saved sometimes, and that’s difficult for a lot of people to understand. But I thought that was a great example of how Mike Summers immediately came out and said, no, the market will take care of it. Well, then it got to the point to where there was so much intrusion here and there that what was the, what was, what was the market, now what was it. So, talk to me a little bit about how we can navigate going into next year, where the industry isn’t really sure how to handle when the market steps in, because, by the way, North Dakota, it’s working great, and in Wyoming, it’s going great, and in Texas, I don’t even think they really pulled the trigger on it but it caused some problems. So, do, you know, what I’m talking about? Are you following me?

U.S. Senator Kevin Cramer: I do. I do know what you’re talking about, and it is very complex, and part of the problem is, remember when two things— First of all, remember in the, in the era of scarcity, when the United States was dependent on Middle Eastern oil, Middle Eastern countries – which are not free market countries; they’re-they’re oil states, the petrol states – they controlled the price and they-they controlled the price by controlling the, you know, the access to the product mainly on the supply side. And they dictated to us what we’d be paying for oil and natural gas and-and the refined products, then all of a sudden, you know, in the Trump era, we become a net exporter where we now are energy dominant. So, but-but remembering that there-there are the economics of oil out of a shale plate versus oil out of the sands of Saudi Arabia are different by hundreds of, several hundred percent different economically. So, you can still suck it out of the sand in Saudi Arabia, put it on barges, and send it to the United States, in some cases, cheaper than you can produce it in Texas and ship it to Houston. You know, and so you have these, you have these market forces, but none of those market forces are completely pure. In fact, they’re nowhere near pure. I would submit to this, first of all, this fundamental, this working theory that I work off of, and-and I would love to take credit for it, but it was former Governor George Sinner, who, in a speech that I heard once, and I’m sure he said it many times, but I was just a young guy, a young political trying to do everything I could to make sure that people like him never got elected again, in full disclosure. He said something very profound in a speech that I’ve never forgotten. He said, “Every sophisticated country in the world will always protect its food supply and its energy supply, because if you never wanted to be dependent on others for it.” And we’ve done that in this country, we still are, you know, we’re twenty percent of the world’s economy but we’re only five percent of the world’s, of the world’s, um, population, but you, that still means that there’s, you know, um, 95 percent of the world that lives somewhere else. And when you’re over-producing, when you’re producing like we are, you-you want to have access to all those other markets. And so now policy and geopolitics enter into it, never mind the fact that the, you know, the main players the main, um, international players in this industry come from very unstable parts of the world, okay. Why do I throw all that as sort of the, you know, sort of the grounding the foundation for it? When you’re dealing on the international stage you need government, because government matters. We fight wars over oil, at least we used to fight wars over over oil; we don’t have to so much anymore. Um, so-so is the market really truly free? Well, during this-this time when you’re talking to Mike and he’s saying, no, let the market decide, we shouldn’t control supply from in the United States, I agree with him. But we also have to remember, what we should be able to control is how much we still import. So just giving the most recent numbers on a reference earlier, December 11th the WTI price on the board was about just under 47 dollars a barrel in North Dakota. The light suite on that same day, it was about 37, so 10 dollars less, but we were still importing, oh, about 336 thousand out of earth— I mean, million, three million, um, 336 thousand barrels of oil into the United States. So here we are in that exporter, but we’re still importing somebody else’s cheaper oil because our refiners, refineries are set up for that. I do think it’s entirely appropriate for a country to use its resources to help the domestic supply remain robust, first of all, so we’re never dependent on others, especially others that that, you know, are not our allies, but our adversaries, places like Iran, Russia, um, you know, even frankly Venezuela. So, we should never be dependent on them. We shouldn’t have to be dependent on them. I do think government intervention, in that sense, is appropriate. I don’t think we ought to, you know, force our refiners or our, force our producers to produce less. We ought to make way, make sure that our consumers are using our products first as often as possible. And your illustration upfront is really an important one. You might recall that in March, I helped organize, along with Larry Kudlow, a meeting in the cabinet room in the White House with President Trump, and in that meeting, there were a whole bunch of CEOs of major oil companies and a couple of my colleagues. Uh, Dan Sullivan was there from Alaska, and Ted Cruz from Texas, and then Harold Hamm and one other, uh, independent producer from Alaska, and Kelsey Warren from-from ATP was there. Otherwise, it was all multinationals, and the difference between an-a domestic producer exclusive, domestic producer like Harold Hamm versus – and I’ll leave out the names of the others – but these multinationals, these multinationals they have business in all these other countries too, so for them, you know, some of this stuff that we’re talking about isn’t all that beneficial. There’s no, there is no disincentive for them to continue or to-to not produce somewhere else, but instead producing the United States of America. That was sort of a convoluted explanation of the, of the dynamics, as it’s woefully inadequate, but I-I worry a lot. I think the independent oil man is worth saving, Jason. At the end of the day, I think that having a supply chain that is, that is American, largely American— Remember, the, in the supply chain, the value chain of energy producing United States of America includes every single state in our country, whether it’s the financing, whether it’s the steel that goes into the pipe, whether it’s the-the, you know, the little bells that get produced or, you know, any number of things, of the food as you, you know, the restaurants that the retailers. I mean, there’s no end to the supply chain for American-made energy and our economy is directly tied to it in a, not an insignificant way, but in a major way and so we can all talk about free markets all we want, but remembering that the world does not share our same values, and we-we are smart, wise, I think, to come up with public policies that knock down barriers to entry, but also that protect the small diverse, diverse producers. Here’s the problem. If we don’t do that, where we’ll head in, where we’ll get eventually, and we’re on our way, you’ll have, like, four major global oil companies or oil and gas companies in the world. They’ll decide where they’re going to drill and they’re going to drill wherever the investment reaps the best reward, and then you lose that entire value to the entire supply chain that’s so critical to a dynamic economy.

Jason Spiess: You just literally answered my next question, because I was going to say, the thing about the Crude Life and the oil and gas industry that really has attracted me is capitalism. And what I mean by capitalism is, you can take any old roughneck who’s been working any old rig, and after 10 years of looking at that same vibrating tube, he’s figured out a way – because of the way his mind works without a college education – he’s figured out a way to make that tube go twice as fast and twice as efficient. And pretty soon, the company that hired him and employs him doesn’t want to steal the idea from him. They want to empower him in his local community, and pretty soon that roughneck without a college education has 15 employees and a, you know, 1.5-million-dollar company and he’s a very good contributor to his local community. And if, all of a sudden, that guy goes through a little bit of a downturn, well, generally that oil and gas company will do everything it can to make sure that they stay in touch with him and keep him somewhat connected through their connections or something else. Now, they’re not into handouts – don’t get me wrong – they’re not in the handouts. They’re-they’re into enabling opportunity and also taking care of community building, and that’s a part that I have not seen in a lot of other industries, is that community building part that the oil and gas companies seem to do, uh, with— I-I call it the last bastion for capitalism, to be honest. That’s why I was so, um, focused on the Mike Summers and-and the Matt Gallagher complete, you know, different dichotomy that’s there, because when you take a look at Texas, man, there’s still wildcatting down there, okay. North Dakota has pretty much turned it into a commodity where they know where most of the oil is and that sort of thing.

U.S. Senator Kevin Cramer: They know how to get it.

Jason Spiess: They know how to get it. Then you go to Alaska, where it’s state-owned oil, it’s, the people own it and what do you got? Two companies up there, two oil companies BP and Shell and that’s about it. So, I look at just the-the transition of those, and what you said is right, that if we keep going the direction we’re going, we will have a handful of companies that control 90 to 95 percent of the global oil supply. So, I just thought that was the Texas to Alaska analogy might be something that people in the United States could take a look at. What do you think on that?

U.S. Senator Kevin Cramer: I think it’s a great point and I think North Dakota is the perfect laboratory, because we do have all of them. We have all sizes, as you know, and-and I’ll go back to this often, you know, there’s a reason North Dakota doesn’t allow corporate farming, and we can argue philosophically why-why that’s good or why that’s bad, but the diversity of a network of family farms provides a security that is not provided if you have a bunch of giant corporate farms. The best-case scenario, the best illustration probably is in the beef business and the meat packing business where we’re now down to four major meat packers, so what’s happened as a result of that is, uh, that lack of diversity means that the rancher doesn’t get enough money to earn a living, but the price of a steak goes up. Well, that’s exactly what will happen in in the oil industry. The, if we get down to a handful of major global producers, they’re going to go to where it’s cheapest to get the oil, and ultimately when they’re very few of them – and by the way, these are vertically integrated companies that also own the shipping companies, they own the refineries, they own the pipelines, and they own the gas stations. They have their brand on the on the, their local on the on the pumps there. Ultimately that will lead to a higher price. Stuart Barney asked me one day, he said, “But Senator,” he said on this show, he said, “I kind of like this, uh, you know, dollar-fifty gas or two dollars, you know, a gallon gas. Don’t you?” And I said, “Well sure, I like it when I’m filling my tank, but I’m not gonna like the six-dollar gas that’s going to come when you kill all of the small producers and Exxon Mobil gets to decide the global price for everybody, um, and then, all of a sudden, you’re gonna long for three-dollar gas, which might provide an opportunity for everybody to to be successful.” So, it’s, uh, you know, sort of Economics 101 but, uh, you know, our-our brand of capitalism, um, can collapse when capitalism is replaced with greed and we need to be very careful to avoid that.

Jason Spiess: Wrapping up here, who’s some of the leaders that, uh, the oil and gas industry should be looking out for? Names and the headlines, if you will. Of course, Senator Kramer, you’re one of them. You’re out there busy as can be, stick it up, uh, for the energy industry. So, who are some of the other ones?

U.S. Senator Kevin Cramer: Yeah, some of the people I’ve worked closely with… Let me go to a Democrat first, but which is going to seem really strange but, um, Sheldon Whitehouse, who, as you know, he-he is a serious serious climate change advocate. He’s not for climate change but advocating, uh, that we need to do more for, to stop climate change. But-but what I like about Sheldon is – and I, and I serve with him on Environmental Public Works Committee – Sheldon is, he’s intellectually honest. Um, I think some of his theories are bizarre, but he’s been very helpful in trying to work with us on things like 45 Q legislation and rules – and that 45 Q is is a tax credit for carbon capture utilization and storage. In other words, um, he wants to see clean coal technologies. And then, you know, another colleague of mine on that Committee who’s a Democrat, Ben Pardon, he’s working closely with me on things like the appropriate tax treatment of-of, um, of nuclear energy. You know, there are other forms of carbon free energy than just wind and solar, and so guys like that you need to, you know, there are people we can work with. Senator Manchin, Joe Manchin, another Democrat who’s on, he’s the ranking Democrat in the Energy Natural Resource Committee. He and I work closely together on a number of things. But the real stars, in my mind, Senator John Barassel from Wyoming. I’ve had the opportunity to serve with him as he’s Chairman of the Environment and Public Works Committee. Next year, he’ll serve as Chairman of the Energy and Natural Resources Committee, sit on both Committees. He has worked very closely with me on a lot of things. Obviously, Wyoming and North Dakota have a lot in common. Uh, Senator Shelly Moore Capital of West Virginia will now become, likely to become the Chairman of the Environment and Public Works Committee next year. Um, and, uh, Tom Carper, the Democrat, is the ranking member. He and I have worked closely together. Again, we don’t agree on everything, but we’re able to find common ground and some compromise. On the House side, I was really pleased to see that Kathy McMorris Rogers from the state of, one of Washington became the ranking Republican on the Energy and Commerce Committee and I know Kathy very well, will work closely with her. Greg Walden, the former chairman and former ranking member, is retiring after this year, so I’d watch for Frank Pallone. He’s a congressman, um, who’s the ranking, or I mean, the Chairman of the Energy and Commerce Committee. And, uh, this is a lot of really good people, uh, that we work closely with out there. We’ll see who the Biden administration puts up for leadership at DOE and, uh, EPA. You know, they’ll be more difficult to work with, no doubt, but we have plenty of allies to make sure that the oil and gas industry remains viable. But the most important thing is that the markets remain viable, the demand remains viable. We gotta wipe out this crazy COVID-19 so that people can get on airplanes again and-and go to Disney World and, you know, and we have international travel again. And those jet airplanes burn a lot of fuel and they’re never going to fly on solar power.

Jason Spiess: Are we at the point where it’s going to take the vaccine to get the economy going or is it—

U.S. Senator Kevin Cramer: Well, it’s interesting you ask that. The vaccine certainly will help, and even, you know, even some of the other measures we— What we need is for people to feel comfortable, um, again getting in their cars and driving to places. Restaurants have to be open, you know, there’s no point in driving to a restaurant if it’s not open. Um, Disney World needs to be at full capacity, or there’s, you know, you’re never going to have the type of of energy use that you’d have when it’s, when it’s wide open. Uh, cruise lines, like I said, you know, airplanes, jets, I mean we need all of that stuff to be operating that will only operate when people are comfortable or, for that matter, when the industries are comfortable, um, letting people, letting people in, so to speak. So, but a lot of that’s driven by mayors and governors, and I, in my view, a lot of them have been way too restrictive and, uh, it hasn’t really worked. I know they all point to mask mandates and and the lockdowns are somehow being successful, and if they were successful there wouldn’t be any COVID-19 in Washington DC, and yet Washington DC, which has had some of the most harsh restrictions throughout several months now, is that a spike. So, um, you know, the economy has suffered greatly at the hands of-of the virus, and more importantly, after, at the unfortunate choices in its response to the virus.

Jason Spiess: Be nice to get some people back out to work and, um, and everything. I think, I-I think some people are using the stimulus and the-the, uh, desire for another stimulus to stay home, and I think there’s a little bit of satiation going on with some people, and if they were not having such easy money that they might be a little more apt to get out into the workplace. Not to downplay the health crisis that’s going on, but I think it’s, uh, there’s a little bit of a mixed bag involved there, to be, to be honest, but—

U.S. Senator Kevin Cramer: Well, there are some perverse incentives that are built in, Jason, no questions, and we shouldn’t, and we should have learned our lesson the first go around. That’s why we’re trying to be so careful going forward. You’re right, there are people that are really hurting and they need help and we should be helping them. We need to help them, and, uh, but there’s the best thing for a restaurant – and I’m happy to help, don’t get me wrong – but the best thing would be for them to have customers again. So that ought to be our focus. Let’s, you know, let’s get people open, let’s get people back to work. The greatest stimulus check is a paycheck and, uh, in the meantime, we need to build a little bridge to help them get there.

About U.S. Senator Kevin Cramer

Kevin Cramer was elected to the United States Senate on November 6, 2018 after serving three terms as North Dakota’s At-Large Member of the United States House of Representatives. He is the first Republican to hold this Senate seat in his lifetime. He serves on the Armed Services, Environment and Public Works, Veterans Affairs, Banking, Housing and Urban Affairs and Budget Committees.

While a member of the House, Cramer made constituent outreach a top priority, describing interacting with the public as “the best part of public service.” According to Legistorm, the Capitol Hill government issues website, Cramer held more town halls than any other Member during several of his years in the House.

Cramer has had a distinguished career in public service. In 2003, then-Governor John Hoeven appointed Cramer to the Public Service Commission, and in 2004 he was elected to the position. As a North Dakota Public Service Commissioner, Cramer helped oversee the most dynamic economy in the nation. He worked to ensure North Dakotans enjoy some of the lowest utility rates in the United States, enhancing their competitive position in the global marketplace. An energy policy expert, Cramer understands America’s energy security is integral to national and economic security.

A strong advocate for the free market system, Cramer has a proven record of cutting and balancing budgets encouraging the private sector through limited, common sense regulations and limited government.

Cramer has a Bachelor of Arts degree from Concordia College in Moorhead, Minnesota, a Master’s degree in Management from the University of Mary in Bismarck, North Dakota, and was conferred the degree of Doctor of Leadership, honoris causa, by the University of Mary on May 4, 2013.

He is a native of Kindred, North Dakota, where he received his primary and secondary education. Kevin and his wife, Kris, have two adult sons, Isaac, who passed away in early 2018 and Ian; two adult daughters, Rachel and Annie; a twelve-year-old son, Abel; two granddaughters, Lyla and Willa; and three grandsons, Beau, Nico and Chet.

Spread the word. Support the industry. Share the energy.

If you have a chance, check out The Crude Life Podcast!