Kunal Patel, Dallas Federal Reserve, joins The Crude Life to breakdown the recent Energy Survey. This quarter’s survey also includes for the first time a set of questions regarding price expectations for oil and natural gas over six-month, one-year, two-year and five-year horizons.

According to Patel, activity in the oil and gas sector was relatively unchanged in the first quarter of 2024, as documented in the survey in regards to oil and gas executives responding to the Dallas Fed Energy Survey.

The business activity index, the survey’s broadest measure of conditions energy firms in the Eleventh District face, was 2.0 in the first quarter, suggesting little to no growth during the quarter. The index was essentially unchanged from last quarter.

Oil and gas production decreased in the first quarter, according to executives at exploration and production (E&P) firms. The oil production index moved down from 5.3 in the fourth quarter to -4.1 in the first quarter, suggesting a small decline in production. Meanwhile, the natural gas production index turned negative, falling sharply from 17.9 to -17.0.

Costs increased at a slightly faster pace for both oilfield services and E&P firms. Among oilfield services firms, the input cost index increased from 21.3 to 31.2. Among E&P firms, the finding and development costs index was relatively unchanged at 24.2. Meanwhile, the lease operating expenses index increased from 22.6 to 33.7.

Oilfield services firms reported modest deterioration in nearly all indicators. The equipment utilization index remained negative but increased from -8.4 in the fourth quarter to -4.2 in the first. The operating margin index moved down from -32.0 to -35.4, suggesting declining margins. The index of prices received for services was unchanged at -6.2.

The aggregate employment index was relatively unchanged at 3.4 in the first quarter. While this is the 13th consecutive positive reading for the index, the low-single-digit reading suggests slow net hiring. The aggregate employee hours index increased from 2.8 in the fourth quarter to 6.9 in the first quarter. Additionally, the aggregate wages and benefits index increased from 21.2 to 32.8.

The company outlook index rebounded in the first quarter, jumping 24 points to 12.0. While the company outlook index increased, it is still below the series average. The overall outlook uncertainty index fell 22 points to 24.1, suggesting that while uncertainty continued to increase on net, fewer firms noted a rise in the recent quarter. The uncertainty index this quarter was slightly above the series average.

On average, respondents expect a West Texas Intermediate (WTI) oil price of $80 per barrel at year-end 2024; responses ranged from $70 to $120 per barrel. When asked about longer-term expectations, respondents on average expect a WTI oil price of $83 per barrel two years from now and $90 per barrel five years from now. Survey participants expect a Henry Hub natural gas price of $2.59 per million British thermal units (MMBtu) at year-end. When asked about longer-term expectations, respondents on average expect a Henry Hub gas price of $3.18 per MMBtu two years from now and $3.94 per MMBtu five years from now. For reference, WTI spot prices averaged $82.52 per barrel during the survey collection period, and Henry Hub spot prices averaged $1.44 per MMBtu.

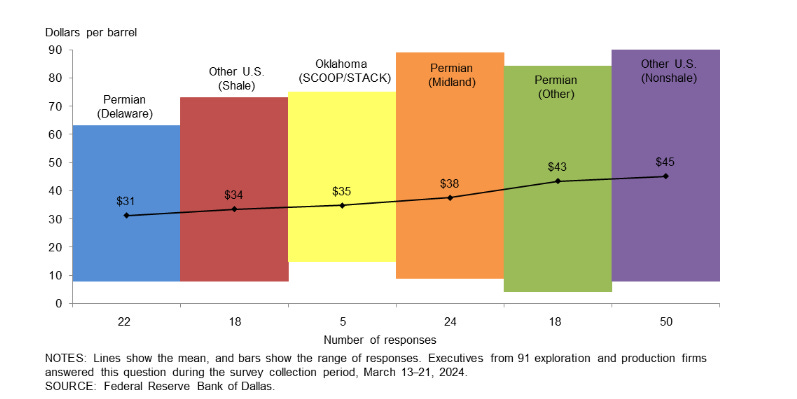

In the top two areas in which your firm is active: What West Texas Intermediate (WTI) oil price does your firm need to cover operating expenses for existing wells?

The average price across the entire sample is approximately $39 per barrel, up from $37 last year. Across regions, the average price necessary to cover operating expenses ranges from $31 to $45 per barrel. Almost all respondents can cover operating expenses for existing wells at current prices.

Large firms (with crude oil production of 10,000 barrels per day or more as of the fourth quarter of 2023) require prices of $26 per barrel to cover operating expenses for existing wells, based on the average of company responses. That compares with $44 for small firms (fewer than 10,000 barrels per day).

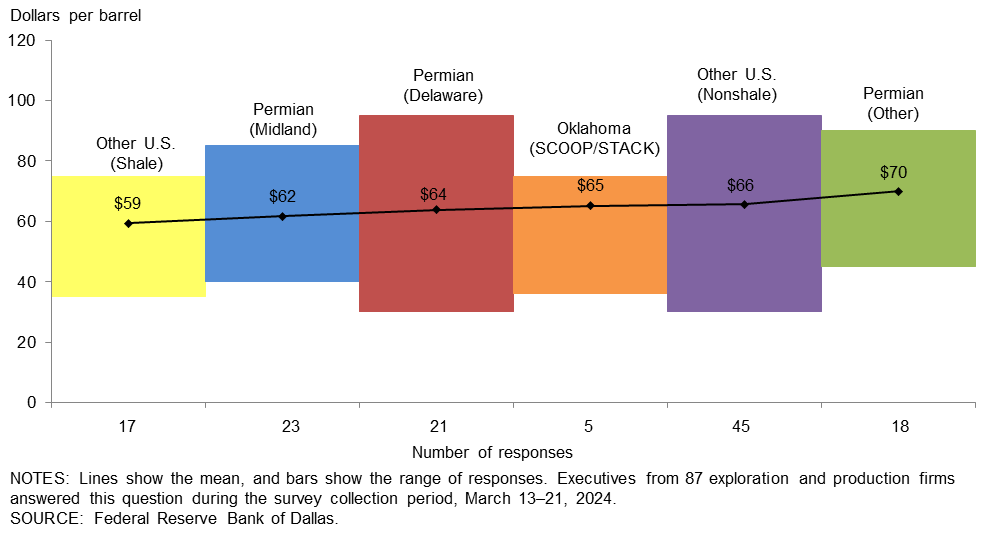

In the top two areas in which your firm is active: What WTI oil price does your firm need to profitably drill a new well?

For the entire sample, firms need $64 per barrel on average to profitably drill, higher than the $62-per-barrel price when this question was asked last year. Across regions, average breakeven prices to profitably drill range from $59 to $70 per barrel. Breakeven prices in the Permian Basin average $65 per barrel, $4 higher than last year. Almost all firms in the survey can profitably drill a new well at current prices. (The WTI spot price was $83 per barrel during the survey period.)

Large firms (with crude oil production of 10,000 barrels per day or more as of the fourth quarter of 2023) require a $58-per-barrel price to profitably drill, based on the average of company responses. That compared with $67 for small firms (fewer than 10,000 barrels per day).

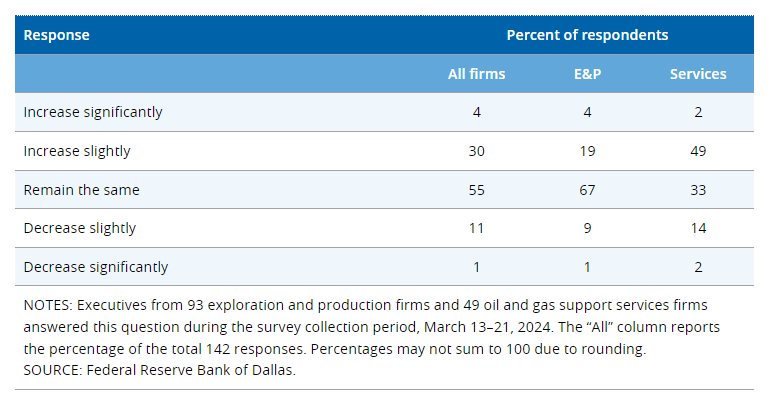

How do you expect the number of employees at your company to change from December 2023 to December 2024?

While the the most-selected response among E&P firms was for employment to “remain the same” in 2024, the most-selected response of support service firms was for employment to “increase slightly.” Only a small percentage of executives expect the number of employees at their firms to decrease. (See table for more detail.)

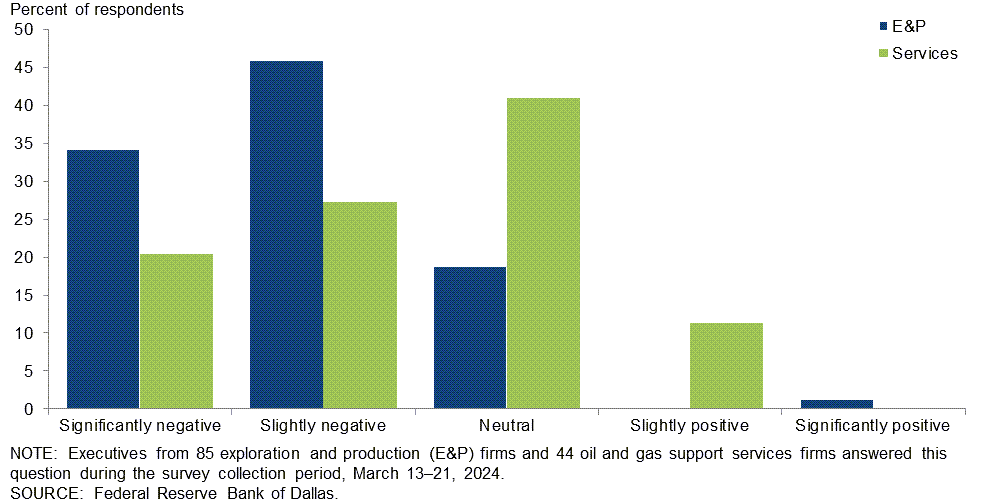

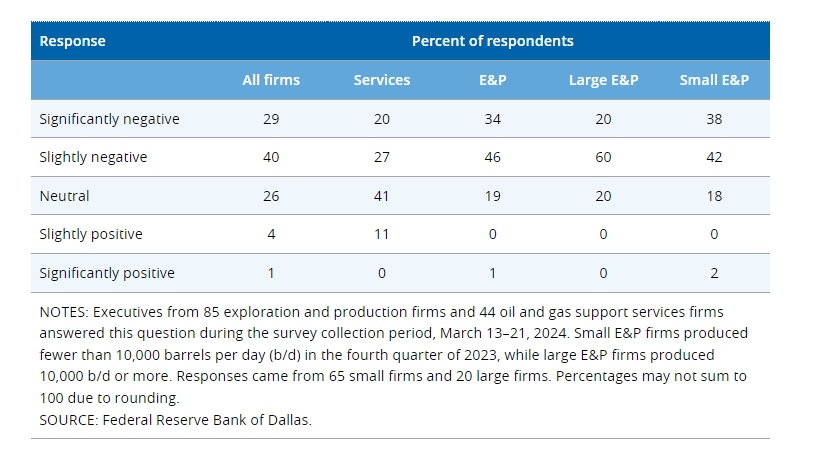

The U.S. Environmental Protection Agency released guidance earlier this year regarding the methane charge from the Inflation Reduction Act. What net impact will the methane charge have on your firm?

The most-selected response among E&P firms was “slightly negative,” chosen by 46 percent of respondents. Another 34 percent selected “significantly negative,” while 19 percent selected “neutral,” and 1 percent expect a positive impact. Meanwhile, the most-selected response among support services firms was “neutral,” chosen by 41 percent of respondents. The next most-popular response was “slightly negative,” selected by 27 percent of support service firms, followed by “significantly negative,” 20 percent. A small group, 11 percent, expect a “slight positive” impact.

When considering small and large E&P firms, executives at small E&P firms were more likely to report a significantly negative impact, 38 percent for small versus 20 for large. (See table for more detail.)

About The Dallas Federal Reserve Survey

Data were collected March 13–21, and 147 energy firms responded. Of the respondents, 97 were exploration and production firms and 50 were oilfield services firms.

The Dallas Fed conducts the Dallas Fed Energy Survey quarterly to obtain a timely assessment of energy activity among oil and gas firms located or headquartered in the Eleventh District. Firms are asked whether business activity, employment, capital expenditures and other indicators increased, decreased or remained unchanged compared with the prior quarter and with the same quarter a year ago. Survey responses are used to calculate an index for each indicator.

Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the previous quarter. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the previous quarter.

Everyday your story is being told by someone. Who is telling your story? Who are you telling your story to?

Email your sustainable story ideas, professional press releases or petro-powered podcast submissions to thecontentcreationstudios(AT)gmail(DOT)com.

#thecrudelife promotes a culture of inclusion and respect through interviews, content creation, live events and partnerships that educate, enrich, and empower people to create a positive social environment for all, regardless of age, race, religion, sexual orientation, or physical or intellectual ability.

MORE FROM THE CRUDE LIFE

- Please click that ♡ button, share, and subscribe.

- Please share the links on social media.

- Thank you thank you thank you for your engagement and support.

f you have a news tip, press release, guest suggestion or other content concepts, please email thecontentcreationstudios(AT)gmail(DOT)com

This post was brought to you in part by one of The Crude Life’s fantastic sponsors, please consider supporting their services or learning more about their organization by clicking on the banner below.

Witting Partners helps energy industry leaders achieve and sustain peak performance by combining an unmatched blend of oil & gas experience, insight, and results with the power of leadership coaching, workshops, and keynotes so that you and your stakeholders don’t un-wittingly damage your odds of achieving long-term success.

If you want to produce 𝑺𝑼𝑺𝑻𝑨𝑰𝑵𝑨𝑩𝑳𝑬 results, then turn to a resource with 15+ years of proven success stretching from the Gulf of Mexico to Appalachia, from service company to operator, and from drilling rig to downtown boardroom.

To learn more, visit Witting Partners’ website or follow on LinkedIn.