This past week the Securities and Exchange Commission (SEC) inched closer to regulating the Environmental Social Governance (ESG) as part of a company’s new world. This is significant for several reasons and something every company who is part of a supply chain should understand.

Specifically, this is something every public company, government group, appointed agency and anyone with a bank loan should understand.

It doesn’t take a rocket scientist to understand many in today’s leadership do no accept any information from people they haven’t had their clique or inner circle preapprove. This isn’t my chip on a shoulder, no, nearly every ESG survey you read cites executive leadership as the number one issue in ESG.

My guess is since real time economies are already being impacted by radical rumors, selective science and special interest insiders, the proof or example is in the current status of this sentence.

Number two is emission management. Specifically, it is Scope 3 they have in the metaphorical sights.

Let’s be clear here class, emission management is extremely complex. There are zero easy answers for this topic, just a ton of judgement, Internet-Educated-Experts and finger-pointing platitudes. But there are some answers, just not as easy as flipping a light switch on and off.

Let’s start with US Senator Kevin Cramer (R-ND), an elected official who sits on committees on Banking, Energy and Environment. This past week, he led of Republican colleagues in calling on SEC Chair Gary Gensler to withdraw the agency’s proposed climate disclosure rule, which would require publicly-traded companies to disclose their greenhouse gas emissions and other information related to climate change.

“After failed attempts to enact radical climate policy via legislation, this rule is yet another example of the Biden Administration’s efforts to have unelected bureaucrats implement its preferred agenda through regulation,” Senator Cramer and others wrote in the letter. “Addressing climate issues is a complex task with widespread consequences across the U.S. economy. We believe devising climate policy is the job of elected lawmakers, not unelected regulators at the SEC.”

The letter outlines the SEC’s lack of regulatory authority to issue a climate change rule, which would impose significant compliance burdens on public companies, and would further push capital away from domestic fossil fuel producers at a time when energy prices for Americans are skyrocketing.

“The proposed rule comes against a backdrop of high inflation, skyrocketing energy prices, and immense efforts to cut off Russian energy supplies. Whether it is putting forth radical nominees to important financial regulatory positions or proposing burdensome regulations like the proposed rule on climate-related disclosure, this administration’s hostility towards fossil fuels is having serious consequences throughout the entire economic value chain and on our domestic energy resources and national security,” continued the letter.

Senator Cramer is joined by Senate Banking Committee Ranking Member Pat Toomey (R-PA), Senate EPW Ranking Member Shelley Moore Capito (R-WV), and Senators Jim Inhofe (R-OK), Mike Crapo (R-ID), Cynthia Lummis (R-WY), Tim Scott (R-SC), Richard Shelby (R-AL), Steve Daines (R-MT), John Boozman (R-AR), Thom Tillis (R-NC), Roger Wicker (R-MS), John Kennedy (R-LA), Dan Sullivan (R-AK), Bill Hagerty (R-TN), Joni Ernst (R-IA), Jerry Moran (R-KS), Lindsey Graham (R-SC), and Mike Rounds (R-SD).

Click here to read the letter.

Unfortunately for the group of elected officials, their letter may not be enough to stop the acronym from becoming part of our professional lexicon.

Last month the SEC proposed significant rule changes to the U.S. Securities Act of 1933 and SEC Act of 1934. If enacted, the proposed amendment, formally known as The Enhancement and Standardization of Climate-Related Disclosures for Investors, will require the full disclosure of climate change risks, by domestic and foreign registrants alike, in their annual SEC reports and SEC registration filings.

This means, for the first time in history, SEC registrants will have the privilege to not only officially disclose information on risks that climate change poses to business operations but also reveal your company’s specific environmental goals and detailed plans to achieve them.

The other headline this ESG University Classroom Column toyed with was something along the wordplay of “Rope A Dope”. Both words rhyme with “scope” and the ESG SEC one-two-combo is nothing short of an unexpected right and left hook to businesses involved with the supply chain.

Allow me to explain further, while ESG opportunists, Yes-Suite-Executives and Platitudinal Podcasters are trying to be ahead of the pack by regurgitating ESG propaganda in anticipation for their direction from their Inner Circle Leadership, the SEC is slowly creating an army of ESG Agents to audit companies and their public promises of climate change and sustainability focused ambitions.

Furthermore, the SEC’s proposed amendment will expose a company’s true intention to its advertised ESG initiatives by revealing and or exposing its energy usage, greenhouse gas emissions, and other ESG metrics.

Bottom line is this. The proposed SEC rule changes are historic and will change the entire way we do business and operate the economy.

This next bottom line is so low to the bottom, you would need a ladder to touch a snake’s belly. If this regulation is passed, there will be a group of appointed snakes who have never worked a day of blue-collar or no-collar work in their life telling you how to run your business and live your life. And before you start thinking these are white-collar leaders, nope, rather, their pedigree is more of a silver spoon that any collar.

This is a real thought exercise folks, the mandated disclosure of your ESG metrics may prove extremely important to your company’s business and financial integrity. And a group of people in the shadows are defining your destiny right now.

However, in public, the shadow group is proposing SEC registrants to disclose:

Specific processes for identifying, assessing, and managing climate-related risks;

- How any identified climate-related risks have had or are likely to affect the registrant’s business model, analytical choices, and projected financial outlook, and/or have a material impact on business and financial statements (i.e. severe weather events);

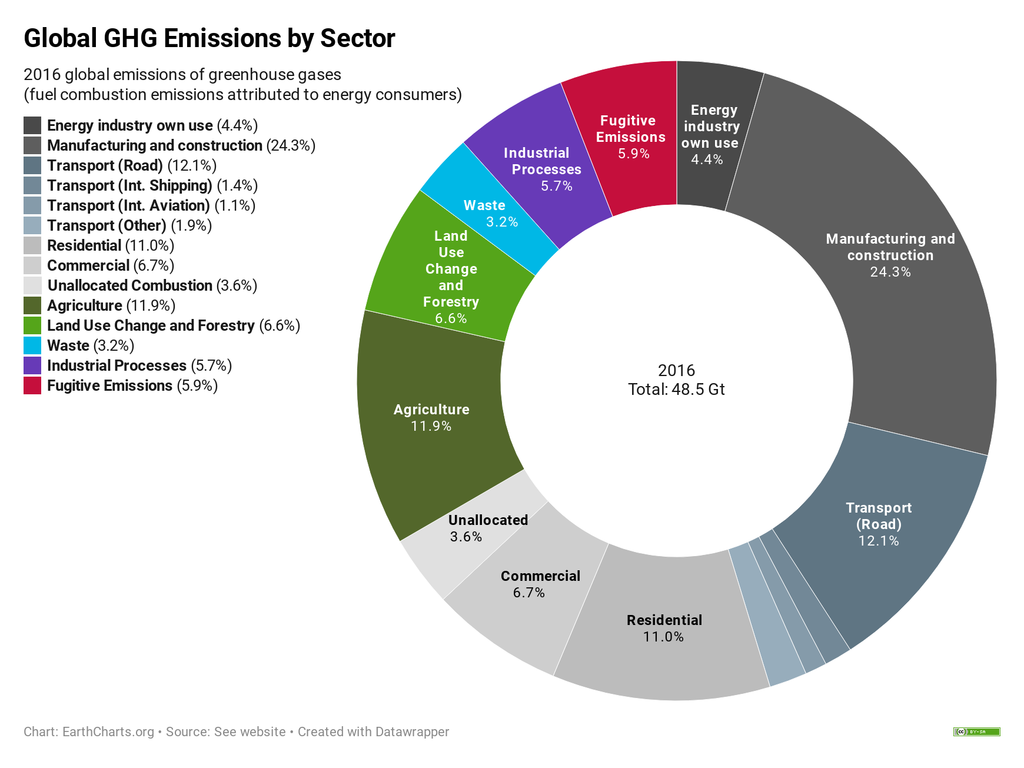

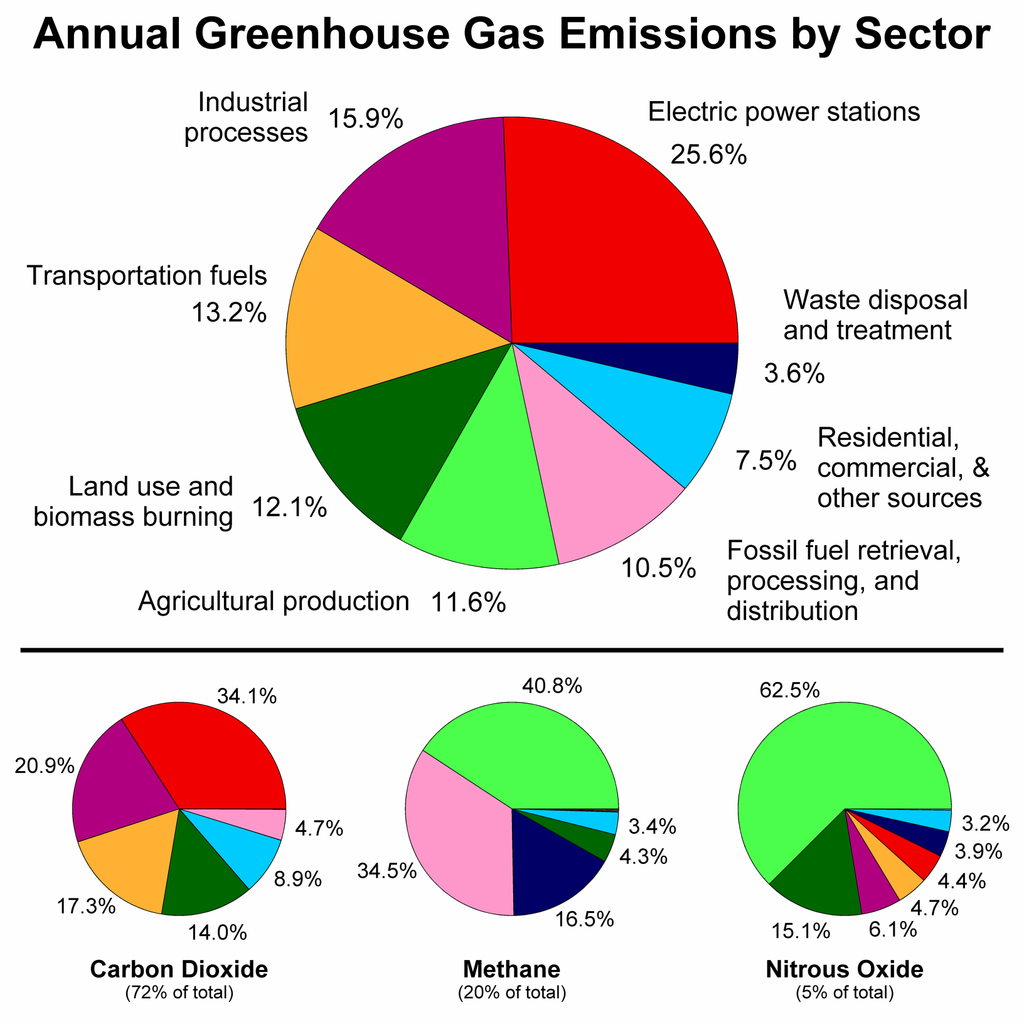

- Direct GHG emissions (Scope 1) and indirect GHG emissions from purchased electricity and other forms of energy (Scope 2); and

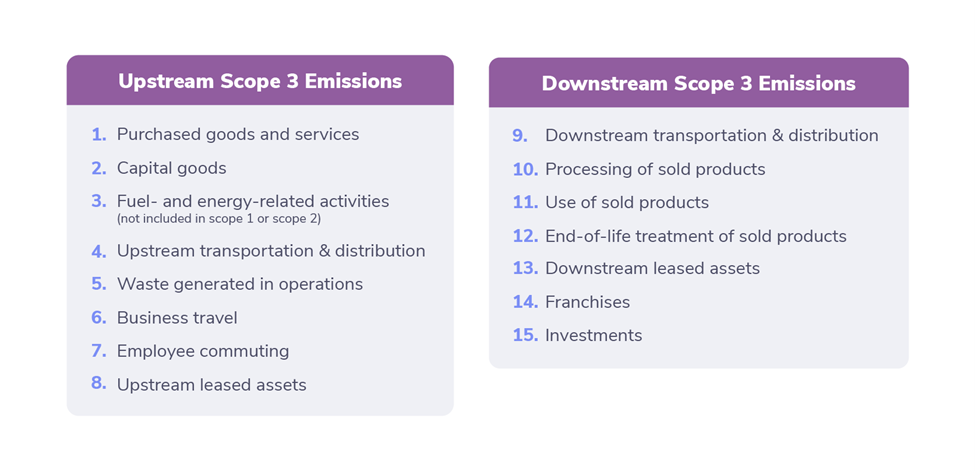

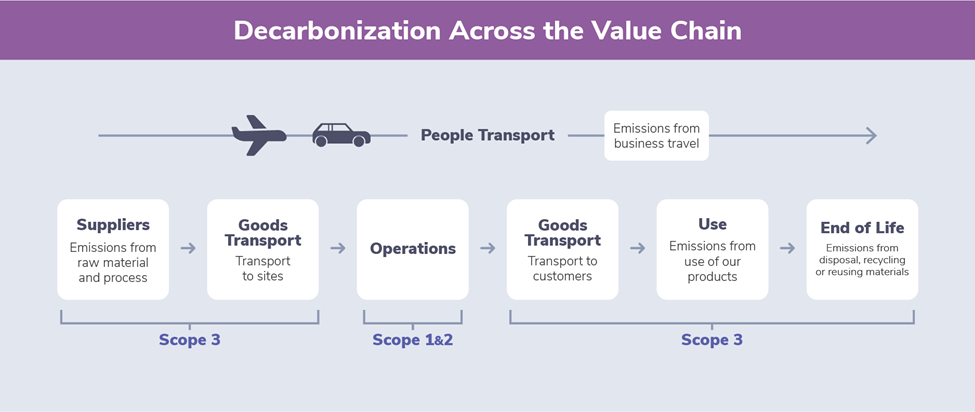

- Indirect emissions from upstream/downstream activities in a registrant’s value chain (Scope 3), whether material or if the registrant has a set GHG emissions target that includes Scope 3 emissions.

What exactly are Scope 1, 2, 3 Emissions?

According to ESGToday, Scope 1 accounts for direct GHG emissions from sources that are owned or controlled by the company. For example, Scope 1 includes emissions from the combustion of company owned or controlled boilers, furnaces, and vehicles, or likewise, emissions from chemical production in company owned or controlled process equipment.

Scope 2 accounts for indirect electricity GHG emissions from the generation of purchased electricity, steam, heating and other energy uses.

Scope 3 emissions includes all other indirect emissions from sources not owned or controlled by the institution but that occur in a company’s value chain, or more specifically, because of a company’s operations (i.e. purchased goods/services, fuel/energy related activities, transportation, waste generated in operations, business travel, and employee commuting).

The logic behind requiring registrants to disclose Scope 1, 2, and 3 GHG emissions is that they relay useful stats for registrants and investors alike, such as: where the emission hotspots are within an organization, resource and energy risks in the supply chain, and cost reduction opportunities in the supply chains.

All kinds of new and neat technical buzz words and and simple authoritative sounding acronyms to keep your company busy with new ESG tasks.

OMG the colorful trendy pictographs they find on the Internet and choreographed planning posts with DoorDash food will be totally amazeballs for your social media enthusiast

Seriously speaking, in my humble opinion, any business that does not understand the significance behind the Scope 3 strategic implications on their operations, should find out what their ESG professional has been doing with their time. Scope 3 is literally in the SEC Scope right now.

Companies and organizations with large supply chains like retailers, manufacturers, logistics operators and industrial businesses will be specifically affected. You know the workers. The ones too busy keeping the lights on and food on the table to be bothered with complex ESG issues.

Scope emissions are not only the number one ESG issue after leadership, but the way it impacts the economy is akin to a literal seismic shift for the global economy. It’s a paradigm shift much like when the Internet changed the newspaper industry.

Consider this, the majority of newspapers in America had a monopoly for 100 years in most cities and the Internet bankrupted 90% or more of them over the span of 10 years. That’s a legit paradigm shift there class. Only that paradigm shift was by market shifts and demand, not special interest leadership dictating lifestyle and financial changes to the world through regulation and picking and choosing who they will direct tax payer dollars to.

The need to plan for managing and understanding the impending ESG regulations and financial implications is now. Anyone ignoring this three-letter acronym will quickly be left behind by more savvy competitors who know how to multitask and hedge bets.

To handle these new complex challenges, business owners and shareholders must position considerations around the seed intention of Scope 3 and the Supply Chain, which seems to be at the heart of their strategic planning.

After a number of communications with the SEC and they are already citing their 2010 desire for ESG-related scores and insists that more aggressive disclosure rules are essential to protect investors. It would appear the ducks are in a row already over at the SEC… are yours?

In closing, I will keep my somewhat targeted and military “Scope” theme going with some bullet points. The SEC also says these are some more climate-related risks that could materially impact your company’s financial performance:

- Severe and frequent natural disasters that damage assets, disrupt operations, and increase overall operational costs;

- Internal transitions to lower carbon products and practices triggered by changes in regulations, consumer preferences, technology and other marketing forces impacting the registrant’s business model; and

- Global commitments to transition to a carbon neutral economy to meet GHG goals could materially impact registrants

In conclusion, not only did I squeeze out two more closing contextual clichés , it allowed me to wrap it up with the current ESG clock that is ticking for businesses with a SEC-backed loan, public shareholders or are involved with the supply chain.

The SEC’s proposed rule changes are open for public comment for 30 days, and there will be lots of barstool shouting and political pundanting in the meantime with self-appointed ESG saviors, however, the reality is Scope 3 emission disclosures are real and will be phased in over a period of time unless something seismic changes the SEC back to normalcy.

At the end of the day, there are no more clichés left.

Class dismissed til next week.

Questions on today’s lesson? Know someone using Ethical Energy? ESG University wants to know who these leaders are as we continue to showcase and highlight ESG solutions in energy. For consideration, please email studio@thecrudelife.com companies, people and organizations showing ESG in action.

ESG University Classroom Column is written by Jason Spiess and no way reflects the mission or position of his other media companies. ESG University is an educational paper with classic newspaper op/ed elements sprinkled in. Because of this, we must categorize the column as Opinion and Editorial and run this disclaimer.

If anyone would like to schedule an interview, meeting or news tip email studio@thecrudelife.com

Industrial Integrity and Energy Ethics are the new entry level expectations in oil and gas, and The Crude Life continues to create original Local, Boots-On-The-Ground Journalism while showcasing other environmentally conscious companies.

Communication is vital in today’s energy extraction and empowerment.

About The Crude Life

The Crude Life produces original content that focuses on industry, the people, energy innovations, community building and it’s proactive culture. Our custom content is non-polarizing, trusted and often news making.

The Crude Life promotes a culture of inclusion and respect through interviews, content creation, live events and partnerships that educate, enrich, and empower people to create a positive social environment for all, regardless of age, race, religion, sexual orientation, or physical or intellectual ability.

Part of our mission is to enable people, companies and communities to affect change, demonstrate their transformative actions and drive energy awareness through storytelling and access to resources.

Sponsors, Music and Other Show Notes

Studio Sponsor: The Industrial Forest

The Industrial Forest is a network of environmentally minded and socially conscious businesses that are using industrial innovations to build a network of sustainable forests across the United States.

Weekly Sponsor: KBL Complete Services

Strikingly dynamic, incomparably strong and absolutely reliable, KBL Complete Services excels at all of your pipeline needs. From AGM Surveys, ILI tool tracking, Digsite Locating, and Equipment Decontamination, to Project Management, KBL Complete Services are ready to make your project a success.

Weekly Sponsor: Great American Mining Co

Great American Mining monetizes wasted, stranded and undervalued gas throughout the oil and gas industry by using it as a power generation source for bitcoin mining. We bring the market and our expertise to the molecule. Our solutions make producers more efficient and profitable while helping to reduce flaring and venting throughout the oil and gas value chain.

Join Podcasters from across the world and all walks of life as they unite to bring civil solutions to life and liberty.

Studio Email and Inbox Sponsor: To Be Announced

Featured Music: Alma Cook

For guest, band or show topic requests, email studio@thecrudelife.com

Spread the word. Support the industry. Share the energy.