Since I began writing for more news outlets outside of oil and gas my inbox has been filled with news tips, press releases and interview ideas. Well this one actually came from the U.S. Securities and Exchange Commission (SEC). About a week ago, Apple filed their report for its 2021 “conflict mineral” audit with the SEC.

This sparked a couple new questions and critical thinking thoughts for this week’s Classroom Column at ESG University. Then it got me thinking about the master of marketing himself, Saul Goodman. Yup, the same Saul Goodman from Breaking Bad and Better Call Saul.

First the “Blood/Conflict Minerals” angle is the obvious, easy, low hanging fruit for the media, if they even reported on this. Apple’s SEC filing revealed that it severed ties with 12 refineries and smelting companies over “suspicions that proceeds from their ore sales were being used to finance armed conflicts”.

This is important in the ESG world because high-tech equipment such as smartphones, tablets and cars are able to operate due to minerals and metals that engage in unethical mining and illegal trade that are controlled by groups of mostly men with assault rifles and aggressive personalities. There are regulations at the United Nation’s level for tin, tungsten, tantalum and gold as well as other minerals and metals that are conflict-affected and high-risk areas in the world. Couple obvious examples areas under the UN Microscope are the Democratic Republic of the Congo and in the US, the Great Lakes region.

Another area that has become on the radar in the past couple years is The Yellow Pine Pit. This is a legacy mining site that was used throughout the 20th century to mine for gold, tungsten, antimony and silver in the historic Stibnite Mining District of central Idaho. Residents in Yellow Pine support the proposed mine because of the employment opportunities it would bring to the area. Environmental groups worry that the mine could be devastating to fish habitat in the area, especially after a stretch of their beloved Meadow Creek became contaminated by waste from 20th century mining operations.

I will come back to these examples in a bit. Now back to Apple and their ESG Score.

Click here for Apple’s SEC Filing

According to the SEC report, Apple dropped a dozen suppliers that mine tin, tantalum, tungsten, and gold (known as 3TG) in the Democratic Republic of the Congo and neighboring countries after they refused to participate in the annual audit or “did not otherwise meet our requirements for the responsible sourcing of minerals”.

Apple reiterates that it requires its suppliers adhere to a “strict code of conduct and identify a wide array of risks, including social, environmental, and human rights risks.”

There are at least two reasons this first reason is relevant to the oil and gas industry. One is that Apple has pushed its suppliers towards transitioning to renewable energy in recent years. The second is that some major (and mid-major) oil companies are requiring service companies and subcontractors to have vaccine cards. These are two different examples that have very similar formulas and templates of new regulation not ending well for the free market or energy empowerment.

“Blood minerals,” as many call them, including Apple, have at times been used to fund armed groups associated with murder, rape, and other human rights violations in the countries where they are mined.

To Apple’s credit, since 2009, they have cut ties with 163 3TG smelters and refiners over violations. Apple started publishing an annual conflict minerals disclosure and report in 2014, and has routinely purged its supply chain of non-compliant companies since they started filing the report.

The second reason Apple’s SEC filing caught my attention is because it reminds how subjective this ESG movement is. For example, the issue of human rights atrocities in mining and marketing are virtually ignored in ESG, whereas being near the climate change conversation gets you double negative ESG points. And that’s just the guilty by association rating criteria.

Personally, I believe the cell phone industry is the leader in polluting the world, and have lots of emotionless facts and boring science data to back it up. However, I know I am in the minority on this cell phone soap box, but I do implore each and everyone to research your cell phone’s impact on the environment. You may not Tweet this article in order save the planet.

The cell phone manufacturing and EV battery industry has come under serious fire the past decade for their unbelievable human rights issues. In fact the Blood Diamond industry got kinda excited because the debate between “Blood Minerals” and “Conflict Minerals” got everyone in leadership to forget about how many people lost their lives so a diamond can become a girl’s best friend.

Diamonds and their terrible history of human rights are so yesterday’s social issue that no one really even remembers Leonardo DiCaprio’s movie “Blood Diamond“, only his failed African accent attempt. Hey, that’s not my opinion, that’s The Daily Show‘s Trevor Noah who mocked Leonardo DiCaprio for his pseudo-South African accent. Just being transparent.

But in all seriousness, Hollywood tried to take on the Blood Diamond industry, and Leo is one of the top stars too. I say tried, because in the end, they really just used the social cause for marketing purposes. And now Leo and his private jets are taking on pipelines and climate change.

Many of the same people who are climate activists and supporters of the climate change narrative are also huge fans of Grammy Award-winning artist Beyoncé and her new corporate partner, Tiffany and Co.. In true Executive Saul Goodman fashion, the pitchman framed the launch as a truly historic moment.

The world famous 128.54 carat yellow Tiffany diamond, that was discovered in South Africa in 1877 at the Kimberley Mine by Charles Lewis Tiffany, was recently reintroduced to the public on the neck of Beyonce with her husband Jay Z standing adjacent. The iconic “blood diamond” company pridefully promoted the fact that Beyoncé is only the fourth woman, and first Black woman, to wear the notorious necklace. There was even a slice of nostalgic engagement too since her predecessors include Audrey Hepburn, who wore the rock in publicity photos for her 1961 movie, “Breakfast at Tiffany’s.”

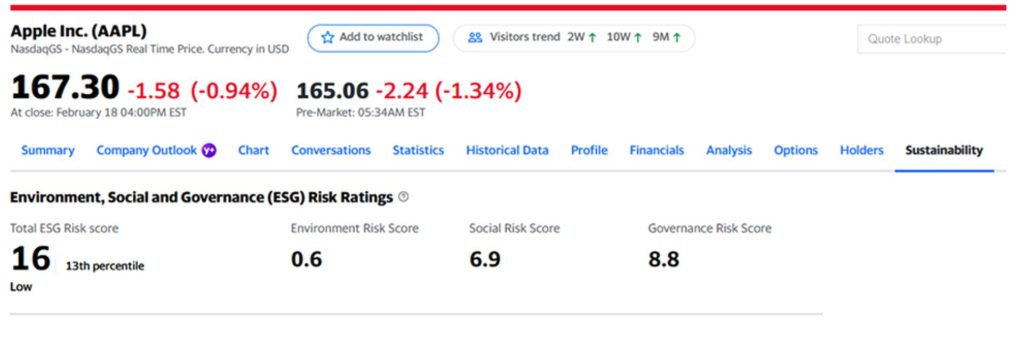

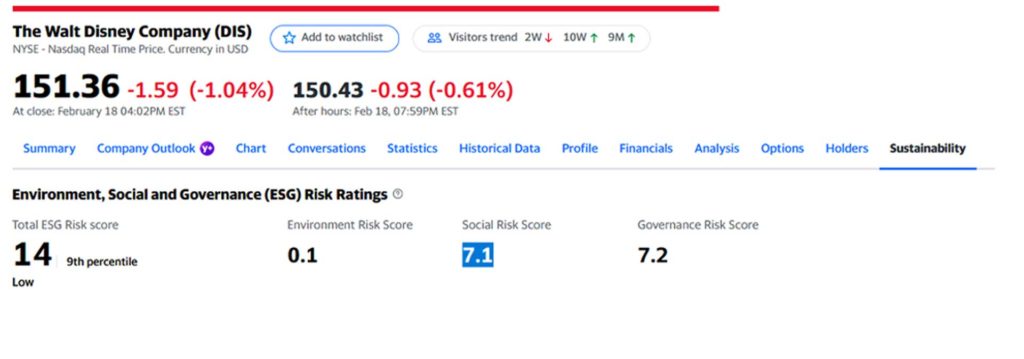

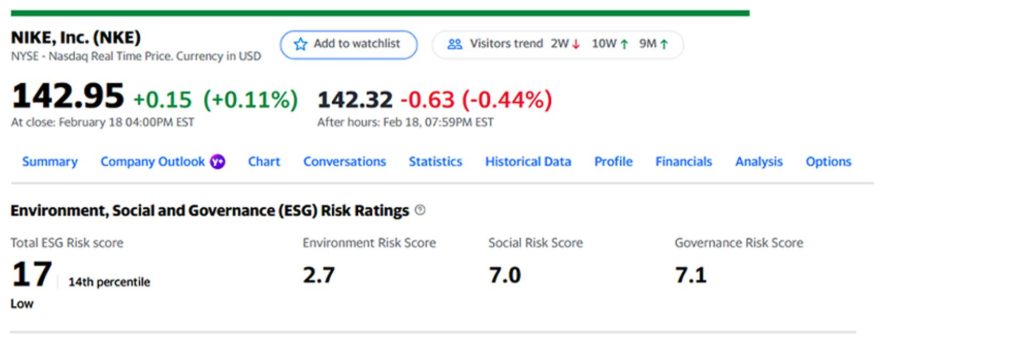

This brings up an interesting question regarding ESG and their criteria for scores. How is worrying and speculating about the future of the climate garnering more negative attention for investing than the current human rights atrocities Apple, Nike, Disney and Adidas are currently committing? I would even push this envelope of Subjective ESG issues to mental health. Forever 21, who is a private company, is not only one of the top sweatshop users, but in my opinion their quest for eternal youth message contributes to more mental health issues in society than CNN and Fox News combined.

Check out how several of the worst violators for human rights and employee awfulness scored in ESG.

Now search for any public oil and gas company and check out their ESG score. Does your oil company have the word “severe” or “low” next to their ranking? That’s how serious they are about the Executive Saul Goodman of linguistical marketing of ESG.

So what is an ESG Score made up of?

Remember ESG Scores are not official yet, even though financial institutions are impacting and influencing investors with them already. But in a nutshell, an ESG score is a rating that evaluates how sustainably a company is conducting business.

A positive ESG score is designed to compel people to invest in a company, either because investors see the company’s values as aligned with their own or because investors view the company as sufficiently shielded from future risks associated with issues such as pollution or poor corporate governance. A less-favorable ESG score is more likely to turn an investor away from the company while at the same time inviting reporters to cite the company as an example of a polluter who isn’t concerned with ESG.

By design or not, ESG Scores take on a whole political world of their own. The ESG Speculating industry could become a billion-dollar industry in three years. Wait, based on the past month of new regulations, maybe a trillion dollar industry in two years.

Many experts believe the current oil and gas leadership is already a decade behind the ESG movement. Here is now subjective ESG scores are. The ESG answers and narrative are typically based on two factors that happen to be easy to say in a sound byte. They are “risk/opportunity exposure and performance”. After one or two of those sound bytes are uttered, usually something is said along the lines of that if a company has a high exposure and performs well, that ESG number can become a big influence that will help impacts the company’s grade.

Did you catch that energy leaders? They are already working on a Letter Grade for you next. The ESG leaders and the Climate Caucuses are going to give Harold Hamm and Aubrey McClendon a letter grade on their business and legacy.

For example if a company is facing a number of lawsuits over environmental practices, they may have a low score and “may be seen as not upholding the integrity of the ESG model”. In the spirit of transparency, that last part in quotes was said by Executive Saul Goodman in my mind after he filed 15 nonsense lawsuits against an oil company in order to drive their stock price down.

This again is just my opinion, but I am generally weary of any language or people who try to control my behavior and freedoms with their subjective rules.

The documented intention of the ESG score is supposed to allow investors to understand a company’s intentions of how they operate. This includes the intangibles too. How treat their employees, how the board makes decisions, if there is nepotism or cronyism, if they have environmental practices and what are they actually doing to be sustainable.

Now consider this. Humans have been decarbonizing as a species for over 150 years. If you look at the research from the Rockefeller Group, it clearly shows how societies have gone from wood and hay to whales to coal to crude to natural gas. That’s an unbelievable history of decarbonization and it was happening long before Greta Thunberg or the Sierra Club came along. Most of the climate activists have just jumped on a movement that was happening on it’s own.

That’s one major issue with ESG. It’s very subjective. Currently the ESG Rulers and Regulators are already penalizing fossil fuel companies for keeping the lights on and homes heated in subzero temperatures while donning fashion from the companies who are making the sweat shop clothes for the ESG regulators and mining their wedding rings at the end of a rifle.

So much of the ESG is surface marketing and public relations. There are some legit qualities with the ESG criteria, but again, industry was achieving many of these innovations and advancements on their own through the free market. Now that the government is in charge of the marketplace, it only makes sense that everyone must fit into their check box world.

In AMC’s Better Call Saul, Jimmy McGill didn’t fit into the system’s intangible subjective check box entitlement program, so he created his own destiny. He decided to actually control his narrative and not host a fundraiser on other people’s dime to talk about whatever issue will get you to give more money.

Nope, Saul Goodman is a market-driven product of Jimmy McGill. Jimmy McGill was labeled and rejected by the establishment. No matter what Jimmy McGill did, the people in power found a way to reject him. A one-sided, shallow technicality that always worked against him. It was nothing short of legally abusing the spirit of the law to pick on Jimmy just because they could. Just because they have the appointed power and he didn’t.

Jimmy McGill was really a sucker for trying to play by the subjective rules the system. The system played him. He not only realized it, but he took action too in order to change his outcome and life. And he hustled.

Saul Goodman controlled his narrative and connected with average people by amplifying his folksy mannerisms. He engaged with a new audience of people who use and need his services. Saul Goodman went outside his network to achieve industry success.

It is time for the oil and gas industry to have a serious look in the mirror because many of the same appointed leaders are still in power.

It is time for the American oil and gas industry to ask their appointed leaders and Madison Avenue marketing executives how they got their butt kicked by a 16-year-old girl from Europe. So much for home turf.

It’s time for the oil and gas industry to ask all their leaders why Bloomberg published an article last week titled “Not Even $200 a Barrel: Shale Giants Swear They Won’t Drill More“.

We tried to ask several appointed leaders in oil and gas about this article, but all we got in return was an opportunity to sponsor their monthly party and networking event to have serious talks about how the industry needs to do more to educate and be accessible.

Class dismissed til next week.

Questions on today’s lesson? Know someone using Ethical Energy? ESG University wants to know who these leaders are as we continue to showcase and highlight ESG solutions in energy. For consideration, please email studio@thecrudelife.com companies, people and organizations showing ESG in action.

Everyday your story is being told by someone. Who is telling your story? Who are you telling your story to?

#thecrudelife promotes a culture of inclusion and respect through interviews, content creation, live events and partnerships that educate, enrich, and empower people to create a positive social environment for all, regardless of age, race, religion, sexual orientation, or physical or intellectual ability.

If anyone would like to schedule an interview, meeting or news tip email studio@thecrudelife.com

Industrial Integrity and Energy Ethics are the new entry level expectations in oil and gas, and The Crude Life continues to create original Local, Boots-On-The-Ground Journalism while showcasing other environmentally conscious companies.

Communication is vital in today’s energy extraction and empowerment.

About The Crude Life

The Crude Life produces original content that focuses on industry, the people, energy innovations, community building and it’s proactive culture. Our custom content is non-polarizing, trusted and often news making.

The Crude Life promotes a culture of inclusion and respect through interviews, content creation, live events and partnerships that educate, enrich, and empower people to create a positive social environment for all, regardless of age, race, religion, sexual orientation, or physical or intellectual ability.

Part of our mission is to enable people, companies and communities to affect change, demonstrate their transformative actions and drive energy awareness through storytelling and access to resources.

Sponsors, Music and Other Show Notes

Studio Sponsor: The Industrial Forest

The Industrial Forest is a network of environmentally minded and socially conscious businesses that are using industrial innovations to build a network of sustainable forests across the United States.

Weekly Sponsor: Black Creek K-9 Pipeline Leak Detection

Disabled Veteran Owned Business in Decatur, TX. Servicing the K-9 industry with pipeline leak detection, detection services, dog training & K-9 consulting. Dwayne Farris served in the United States Marine Corps as a Military Police Officer, assigned to be a Military Working Dog Handler. Upon the honorable completion of active duty, he continued as a reservist for the U.S. Marine Corps Military Police Detachment located in Wahpeton, North Dakota as a squad leader. He was later promoted to the rank of Staff Sergeant.

As a civilian contractor, Dwayne operated for various high-profile U.S.-based security companies deployed to support Operation Enduring Freedom and Operation Iraqi Freedom. He served as a Combat Canine Tracking Handler, Trainer, Kennel Master, and Program Manager. His most recent experience was as the field-based Supervisory Subject Matter Expert working for TSA as the Regional Canine Coordinator for Region 5 based in Seattle, WA. In that position, he regionally oversaw all National Explosive Detection Canine Training Program assigned canine teams. For the Pacific Northwest area of operations, he served as a Regional Canine Training Instructor for the NEDCTP. Prior to joining the TSA, Dwayne was a Multi-Purpose Canine Trainer at Joint Base Lewis-McChord, Washington, for a special operations unit training and deploying K-9 teams in support of world-wide missions.

Weekly Sponsor: Great American Mining Co

Great American Mining monetizes wasted, stranded and undervalued gas throughout the oil and gas industry by using it as a power generation source for bitcoin mining. We bring the market and our expertise to the molecule. Our solutions make producers more efficient and profitable while helping to reduce flaring and venting throughout the oil and gas value chain.

Join Podcasters from across the world and all walks of life as they unite to bring civil solutions to life and liberty.

Studio Email and Inbox Sponsor: To Be Announced

Featured Music: Alma Cook

For guest, band or show topic requests, email studio@thecrudelife.com

Spread the word. Support the industry. Share the energy.