Kunal Patel, senior business economist, Federal Reserve Bank of Dallas, joins Jason Spiess to dissect their 4th Quarter Survey of 134 energy firms, 90 were exploration and production firms and 44 were oilfield services firms.

The oil and gas sector continued growing in fourth quarter 2021, according to oil and gas executives responding to the Dallas Fed Energy Survey. The business activity index—the survey’s broadest measure of conditions facing Eleventh District energy firms—remained elevated at 42.6, essentially unchanged from its third-quarter reading.

Oil production increased at a faster pace, according to executives at exploration and production (E&P) firms. The oil production index moved up from 10.7 in the third quarter to 19.1 in the fourth quarter. Similarly, the natural gas production index advanced seven points to 26.1.

Costs rose sharply for a third straight quarter. Among oilfield services firms, the index for input costs increased from 60.8 to 69.8—a record high and suggestive of significant cost pressures. Only one of the 44 responding oilfield services firms reported lower input costs this quarter. Among E&P firms, the index for finding and development costs advanced from 33.0 in the third quarter to 44.9 in the fourth. Additionally, the index for lease operating expenses also increased, from 29.4 to 42.0. Both of these indexes reached their highest readings in the survey’s five-year history.

Oilfield services firms reported improvement across all indicators, although the pace of growth for some indicators has slowed. The equipment utilization index edged up from 47.8 in the third quarter to 51.1 in the fourth. The operating margin index remained positive but declined from 21.8 to 11.6. The index of prices received for services also remained positive but fell from 42.2 to 30.3.

Labor market indicators showed further growth in the fourth quarter. The aggregate employment index posted a fourth consecutive positive reading, though it edged down from 14.0 to 11.9. Employment growth continued to be driven primarily by oilfield services firms; the employment index was 22.7 for services firms versus 6.7 for E&P firms. The aggregate employee hours index was largely unchanged at 18.0. The aggregate wages and benefits index moved higher, from 30.3 to 36.6—a record high.

Six-month outlooks improved, with the index remaining positive but declining from 58.9 last quarter to 53.2 in the fourth quarter. The outlook uncertainty index fell to -1.5, with the near-zero reading indicating that uncertainty is relatively unchanged compared with the prior quarter.

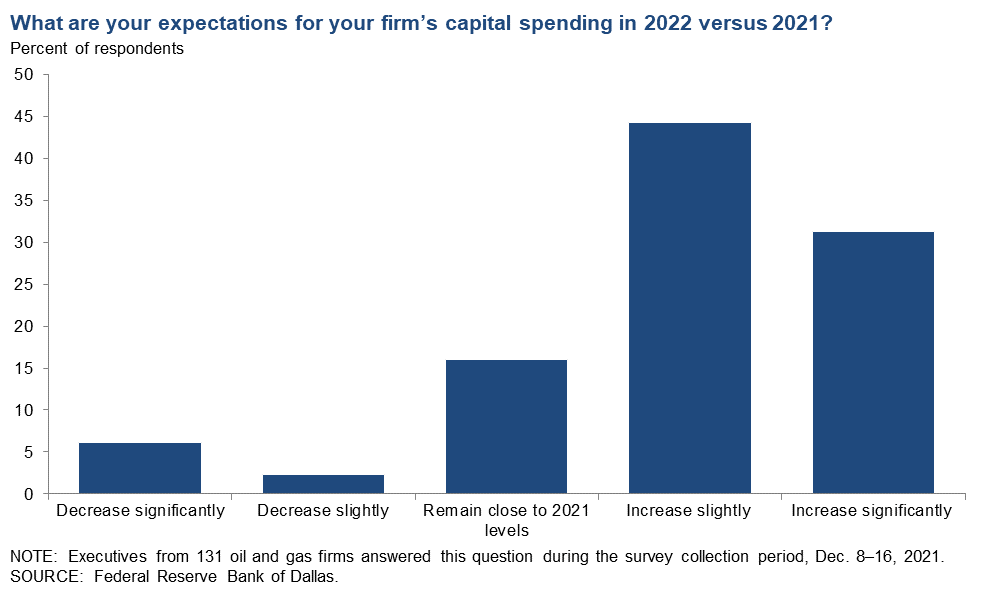

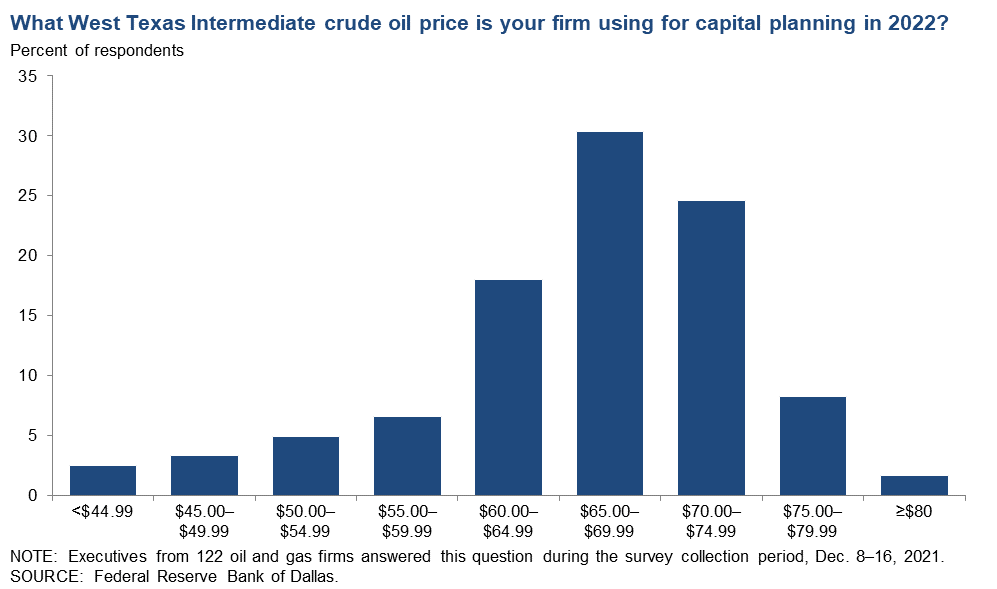

On average, respondents expect a West Texas Intermediate (WTI) oil price of $75 per barrel by year-end 2022; responses ranged from $50 to $125 per barrel. Survey participants expect Henry Hub natural gas prices of $4.06 per million British thermal units (MMBtu) at year-end 2022. For reference, WTI spot prices averaged $71 per barrel during the survey collection period, and Henry Hub spot prices averaged $3.76 per MMBtu.

To see the 4th Quarter study, click here

Everyday your story is being told by someone. Who is telling your story? Who are you telling your story to?

In addition to hosting interviews on The Crude Life, Jason Spiess hosts several radio programs, pens magazine columns and is a podcaster on The United Podcast of America.

If anyone would like to schedule an interview, meeting or news tip email studio@thecrudelife.com

Industrial Integrity and Energy Ethics are the new entry level expectations in oil and gas, and The Crude Life continues to create original Local, Boots-On-The-Ground Journalism while showcasing other environmentally conscious companies.

Communication is vital in today’s energy extraction and empowerment.

About The Crude Life

The Crude Life produces original content that focuses on industry, the people, energy innovations, community building and it’s proactive culture. Our custom content is non-polarizing, trusted and often news making.

The Crude Life promotes a culture of inclusion and respect through interviews, content creation, live events and partnerships that educate, enrich, and empower people to create a positive social environment for all, regardless of age, race, religion, sexual orientation, or physical or intellectual ability.

Part of our mission is to enable people, companies and communities to affect change, demonstrate their transformative actions and drive energy awareness through storytelling and access to resources.

Sponsors, Music and Other Show Notes

Studio Sponsor: The Industrial Forest

The Industrial Forest is a network of environmentally minded and socially conscious businesses that are using industrial innovations to build a network of sustainable forests across the United States.

Weekly Sponsor: Black Creek Pipeline Leak Detection

Especially designed for the American Directional Driller® to measure bottom hole assembly equipment up to 40 feet. As of release, this product is unmatched in the marketplace. This heavy-duty 40-foot tape measure has three measurement scales on an extra wide blade.

Both engineering scale (decimal feet) and imperial scale (inches / feet) are shown on the top side of the blade. The reverse side of the blade is metric for expat or international mobile assignments. There are 12.2 meters shown as 1,220 centimeters with highlighted markings every decimeter and meter. The smallest measurement unit shown is 100ths of feet, 16ths of inches, and 1 millimeter. This tape measure is Class II.

Weekly Sponsor: MineralTracker

MineralTracker is the only mineral management software that allows mineral owners to compare actual royalty payments to expected payments based on well performance and a proprietary, Bakken-specific reservoir model built by MineralTracker’s petroleum engineers.

MineralTracker was formed in Watford City, North Dakota, and is a subsidiary of First International Bank & Trust, a family-owned bank also based in Watford City.

Phone Line Sponsor: Swan Energy, Inc. 866.539.0860

Studio Email and Inbox Sponsor: To Be Announced

Featured Music: Alma Cook

For guest, band or show topic requests, email studio@thecrudelife.com

Spread the word. Support the industry. Share the energy.