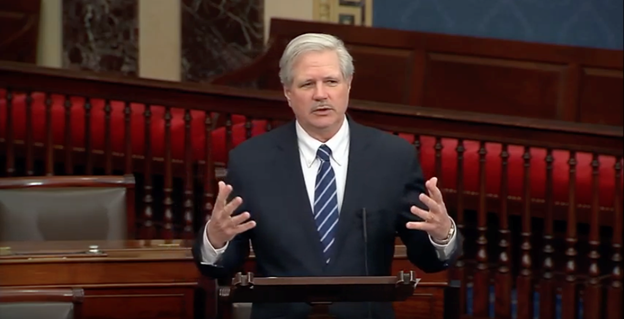

Senator John Hoeven, a member of the Senate Energy and Natural Resources Committee, held a virtual roundtable with members of the Lignite Energy Council to discuss his efforts to support coal in the nation’s energy mix and ensure the country continues to harness this abundant energy resource. This includes:

- Ensuring coal is fairly valued as a reliable source of baseload power.

- Supporting the development of carbon capture, utilization and storage (CCUS) technologies, including advancing an expanded 45Q tax credit.

“We need baseload power in this country, and coal is an abundant, always-available fuel that can meet this essential need,” said Hoeven. “Our efforts are about recognizing and appropriately valuing coal’s contributions to the grid’s reliability and resiliency. Further, through CCUS technologies and the 45Q tax credit, we can both reduce emissions and create an additional revenue stream for coal producers. That’s a win-win for our nation and represents a real opportunity to maintain our state’s leadership in energy production.”

Fair Value for Coal

Hoeven has been working to ensure coal’s role as a reliable source of baseload power is properly valued. To this end, the senator:

- Has been pressing the Federal Energy Regulatory Commission (FERC) and the administration, including Energy Secretary Dan Brouillette, on this issue.

- Introduced an amendment, along with Senator Kevin Cramer, to repeal the one-year extension of the Wind Production Tax Credit (PTC).

- Worked to provide much-needed regulatory relief for the nation’s energy producers, including repealing burdensome rules on coal and lignite producers.

CCUS Technology

In order to advance CCUS technology in North Dakota, Hoeven has worked through his role on the Energy and Water Development Appropriations Committee to fund the Plains Carbon Dioxide Reduction (PCOR) Partnership, which is led by the University of North Dakota’s Energy & Environmental Research Center (EERC), as well as the CarbonSAFE Initiative. This Department of Energy program awarded $17 million to EERC earlier this year for Project Tundra, bringing the total funding Hoeven has secured for the project to approximately $43 million.

Further, the senator has worked closely with the White House, Department of the Treasury and the Department of Energy to get the 45Q tax credit implemented in a manner that will make CCUS projects more commercially-viable:

- Hoeven previously worked to pass legislation to reform and expand the 45Q tax credit and advanced the 45Q tax credit’s implementation, including raising the issue with President Trump and White House Chief of Staff Mark Meadows.

-

Following Hoeven’s efforts, the U.S. Department of the Treasury issued rules to

implement

the credit, including two provisions the senator helped secure to

benefit coal facilities, enhanced oil and gas recovery (EOR) operations

and project developers in North Dakota:

- An expanded definition of Carbon Capture Equipment (CCE), providing broader eligibility for the tax credit, including for the state’s coal-fired power plants.

- A provision, similar to Hoeven’s CO2 Regulatory Certainty Act, to ensure the tax credit works both for long-term storage and enhanced oil recovery.

The Crude Life Podcast can be heard every Monday through Thursday with a Week in Review on Friday.

Spread the word. Support the industry. Share the energy.