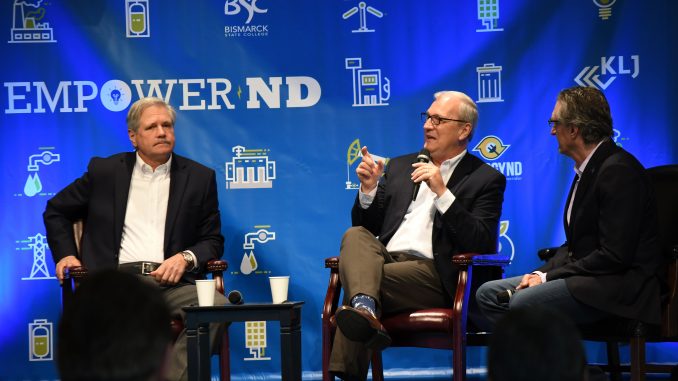

| By Senators John Hoeven and Kevin Cramer and Representative Kelly Armstrong |

| BISMARCK – U.S. Senators John Hoeven and Kevin Cramer and Representative Kelly Armstrong wrote the following opinion piece: “On March 27, President Trump signed bipartisan legislation providing unprecedented support for combatting the coronavirus disease 2019 (COVID—19) pandemic. “In addition to greatly increasing support for health care providers and life-saving medical equipment, the Coronavirus Aid, Relief, and Economic Security (CARES) Act helps address the economic downturn caused by COVID-19 by injecting immediate relief into the economy and giving assistance to American families and workers who need it most. It builds on the emergency supplemental funding bill we passed early in March and the targeted relief we passed shortly thereafter. “The best way to fight the effects of COVID—19 is to fight the pandemic itself, which is why we helped secure $100 billion for hospitals and health care providers who are working to help sick people recover and to ultimately develop effective treatments and a vaccine. “The CARES Act also includes $45 billion for FEMA disaster relief; $16 billion to purchase personal protective equipment (PPEs), ventilators and other medical supplies; $11 billion for vaccines, diagnostics and preparedness needs; $4.3 billion for the Centers for Disease Control and Prevention and $1 billion for the Defense Production Act so manufacturers can ramp up the production of critically needed supplies. We are grateful for the tireless efforts of our health care providers and are fully committed to getting the medical community the resources it needs to end this pandemic. “As they do so, we want to make sure American families, workers and businesses can weather this storm. A key component of the CARES Act is the Paycheck Protection Program, which provides eight weeks of cash-flow assistance to small businesses who maintain their payroll during the emergency. The primary purpose of this program is to ensure that employees continue to get paid by their employer and face as little financial disruption as possible. “The program – administered by the Small Business Administration, through a partnership with local banks and credit unions – can cover payroll costs, paid sick leave, supply chain disruptions, employee salaries, health insurance premiums, mortgage payments, and other debt obligations. This gives small businesses immediate access to capital. Employers’ payroll, rent and mortgage interest expenses will be forgiven, helping workers remain employed and small businesses, as well as the entire economy, to quickly bounce back when this is over. For those who have questions, the SBA has an informative page online at sba.gov, and the SBA in North Dakota is ready and available to assist. “Despite these efforts, unfortunately not all layoffs are preventable. For those who face unemployment or lowered income, the CARES Act provides federal assistance to bolster the unemployment insurance program run by Job Service ND. The temporary expansion of the program allows people who are self-employed, independent contractors, gig workers, and others to receive assistance. “The CARES Act also provides additional benefits to each recipient of unemployment insurance for up to four months and an additional 13 weeks of unemployment benefits after state benefits are no longer available. The CARES Act also authorized an additional $600 weekly federal unemployment payment through July. These benefits will help people to cover expenses during this unexpected lapse in employment. For those needing guidance, Job Service ND is ready and willing to assist. “Lastly, the CARES Act authorized immediate, direct help for American families. Soon, the Treasury Department will be sending out a one-time payment of $1,200 for individuals whose income was $75,000 or under. Couples earning up to $150,000 will receive $2,400. Single parents who make less than $112,500 are also eligible. Qualifying North Dakotans will also get an additional $500 for each of their children. The credit begins to phase out as your income increases, but any individual earning less than $99,000 or a couple making less than $198,000 will receive a payment. The payment is not taxable, and people with no income or whose only income is Social Security payments are also eligible. “This is just the topline of what the CARES Act contains, with increased benefits for veterans, agriculture and many others. As you apply to receive these benefits, do not hesitate to reach out to us and the relevant state and federal agencies. We stand ready to help you, the people of North Dakota, receive the assistance you need during this trying time.” Click here or here to read the piece. |